An Opportune Time to Gain Exposure to Asia Pacific Real Estate

July 2022

Why APAC? Why Now?

Asia Pacific (APAC) is already home to some of the world’s largest economies and is now set to lead global economic growth in the next five years. What is moving the needle now for the APAC region?

In these post-Covid times of moderate economic growth and tighter monetary policies globally, a bigger wave of progression for APAC is anticipated to push through. Emerging Asian countries are blazing the trail in global urbanization, on the back of the outsized scale of rural-urban migration. At the same time, consumer spending growth is forecast to be strongest globally in the emerging markets of China, India and Southeast Asia into the next decade.

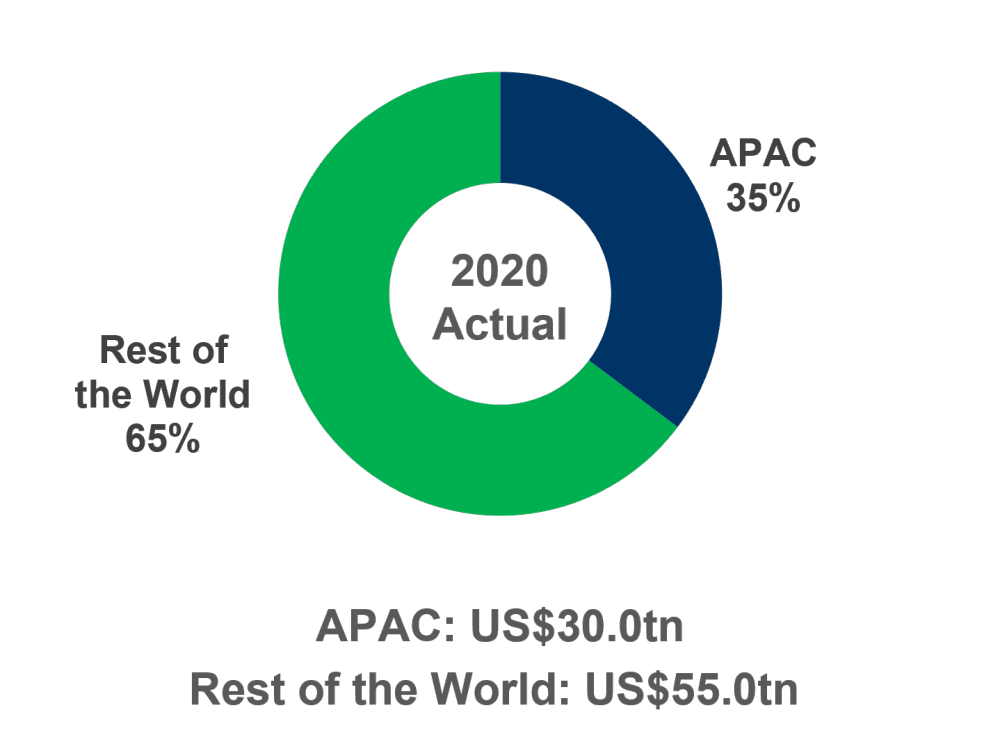

APAC has been the leading region through all economic downcycles over the last two decades, proving its economic resilience, and is set to continue this positive trajectory towards achieving robust economic gains in the next few years, with the region projected to contribute more than 40% of global GDP by 2030.

There are three key themes for investors to note:

01 APAC tailwinds to mitigate global headwinds

The global economy is facing one of the most challenging periods in over a decade, with considerable headwinds stemming from a myriad of events, including geopolitical conflicts, the Covid-19 pandemic, supply-chain disruptions, decade-high inflation, and accelerated tightening of monetary policies. The competitive advantages of APAC place the region in a strategic position as an attractive investment destination to institutional investors for the long term and should serve to limit any potential downside from the uncertainties in the global environment. Positive macro fundamentals and favorable secular trends are likely to continue to drive incremental demand for quality real estate products, underpinned by:

APAC’s dominance in global economic growth, led by China, India and Southeast Asia:

Growth in APAC is expected to average 4.4% through 2022-261, and to considerably outpace the global (3.1%), US (2.2%) and Eurozone (2.1%) averages. Australia (3.2%) and Singapore (2.8%) are forecast to be among the fastest growing developed economies, while half of the top 10 largest economies globally will be in APAC over the next decade.

Resilience and growing importance of APAC in the global context:

APAC has emerged as the leading region through all economic downcycles since 2000; including the 2000-01 Dotcom bust, the 2008-09 Global Financial Crisis (GFC) and the height of the Covid outbreak in 2020. The region is increasingly more dominant and will make up 40% of global GDP by 2030, up from 28% and 35% in 2010 and 2020, respectively (Figure 1). The investible real estate universe in the APAC region2 will grow in tandem with the sustained robust growth of its economy, with a further boost from its incremental market share of the global economy.

Outsized scale of rural-urban migration3:

Emerging APAC countries – namely, China (16.6m annual increase in urban population), India (9.7m) and Indonesia (3.5m) – are expected to lead the rise in urbanization rates globally into the next decade. The sheer scale of rural-urban migration in these countries will present an outsized potential demand pool for real estate and infrastructure products.

Figure 1: APAC Share of Global GDP

(% of Global GDP, US$ in nominal terms)

Source: Oxford Economics, CLI Group Research, June 2022

Rapid expansion in the higher value add services sector4:

Growth of the tertiary sector of major economies in APAC considerably outpaced their US and European counterparts over the last decade and this trend is expected to persist. Annual services sector growth through 2022-305 is projected to be the strongest in India (8.1%) and China (5.3%). Australia (3.6%) and Singapore (2.9%) are projected to lead developed countries globally through the same period, compared to the US (2.2%), UK (2.1%) and Germany (1.4%).

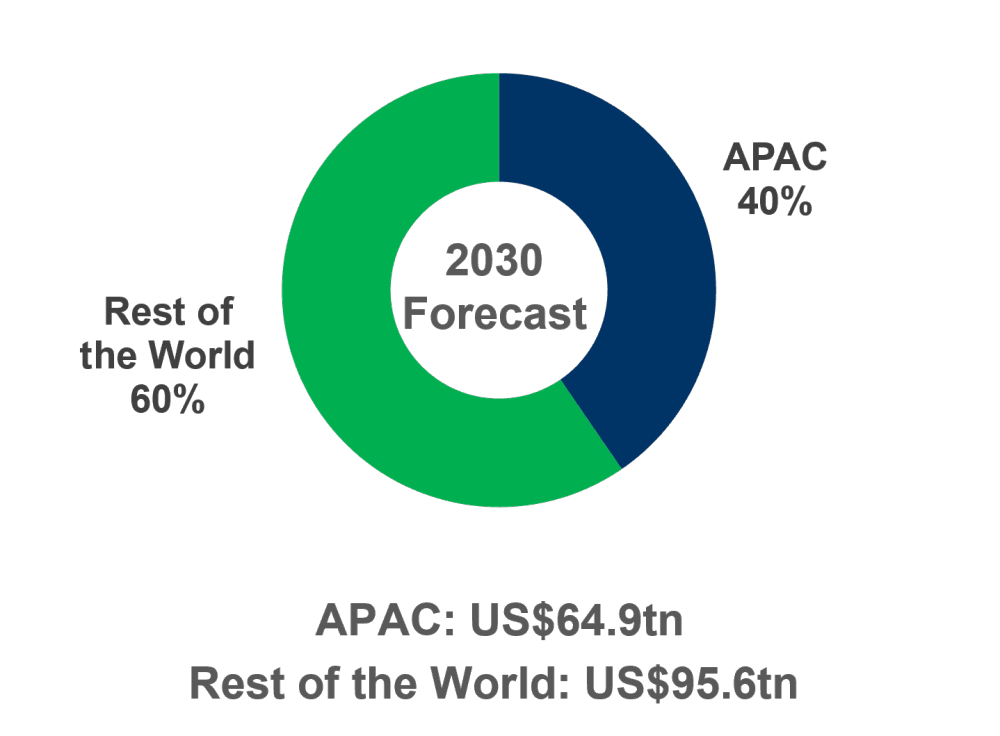

Rise of the consumer class to be most prevalent in APAC:

On a per-capita basis, consumer spending growth rates over 2022-30 are forecast to be strongest in the emerging markets of China, India and Southeast Asia, underpinned by favorable demographics and rapid urbanization (Figure 2). Australia and Singapore are projected to lead growth among the developed markets, in part driven by sustained healthy economic growth, as well as stable and tight employment market.

Moreover, there are several additional structural trends which we believe will contribute to the underlying strength and attractiveness of the real estate sector in APAC over the next few years. They include: (1) sustained infrastructure spending and improvements; (2) rise of Environmental, Social, and Governance (ESG); (3) digitalisation and automation; and (4) demand-supply mismatch due to elevated flight-to-quality requirements.

Figure 2: Growth in Nominal Consumer Spending Per Capita

(US$ per Capita, Nominal) (CAGR)

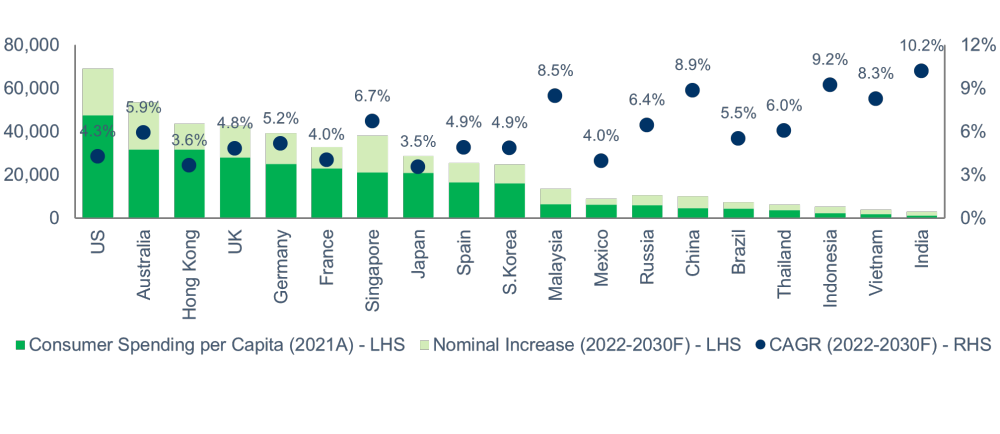

02 Divergence in monetary policies between the East and the West

Inflation is at multi-decade highs in the US and the Eurozone, but relatively benign in parts of Asia, i.e., China and Japan. Inflationary pressures, however, are more prevalent in select higher growth developed countries (e.g., Singapore and Australia), albeit still at comparatively manageable levels.

Widening divergence in monetary policies globally is increasingly evident, as central banks move to deal with the incessantly high inflation. The degree to which monetary policies may be out of sync in parts of APAC with the rest of the global economy is noteworthy (Figure 3) and the dispersion can offer interesting and attractive risk adjusted investment opportunities in the region.

Figure 3: Global Monetary Policy Divergence is Evident

03 Property returns exhibit more nuances at the country and sector level

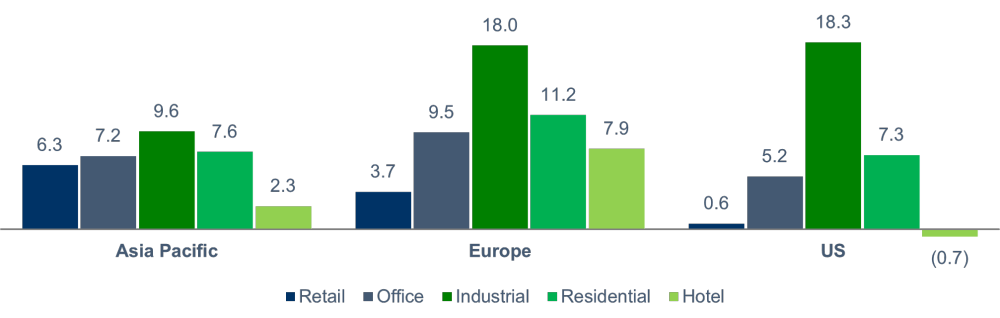

While there is some fluctuation in total returns across all regions in the various historical time frames, owing to uneven capital returns, income returns have been largely stable and at similar levels for each region (at 4-5%). The total returns profile however is more distinct at the asset class level (Figure 4).

Within APAC, the shift in market-specific drivers and fundamentals can be evidenced by the dynamic shift in total returns by country and sector year to year. Diving deeper, property returns at the country, sector and city level further lend to the notion that property market fundamentals across APAC are highly diverse and disparate, and this will remain a key feature of the region going forward.

Figure 4: Regional Returns6 (%) – By Asset Class (2017-2021 Average)

Deeper Insights Are Essential In The Highly Diverse APAC Region

The property sector in the APAC region has evolved considerably over the last decade and is becoming progressively more institutionalized. This is clearly evidenced by the increased market liquidity, with total commercial real estate transaction volume in the APAC region having exceeded US$200bn7 for the first time in 2021.

Notably, institutional investor interest in new economy assets8 has accelerated in recent years, with total transaction volumes having more than tripled over the last five years, reaching US$37bn (+22% YoY) in 2021, whilst the deal count has also more than doubled over the same period. While the APAC region is likely to see keener investor interest going forward, the highly distinct real estate markets in the region are by and large complicated to navigate. Deeper insights are essential in market selection and assessing new opportunities.

An intimate knowledge of local markets and execution capabilities is often the key determinant of success, due to the varied demand drivers and underlying real estate fundamentals across the region characterized by:

Marked heterogenity in the property cycle

Positions of major APAC countries vary considerably across the space and capital market cycles. Deep understanding of local real estate dynamics and operating capabilities are essential to unlock potential investment returns.

Wide spectrum of investment opportunities

The diversity within investable markets across the region offers a broad selection of available investment options to cater to varying degrees of investor risk appetite.

Investing into real estate across the region over the next few years, against a backdrop of evolving government policies, rising interest rates, elevated asset pricing, escalating construction costs, etc., is likely to be increasingly challenging. However, new opportunities with attractive risk-adjusted returns will typically also emerge during these periods, in part driven by the cyclical rebound, credit market gaps and pricing dislocations (e.g., special situations, distressed situations and credit opportunities in China9).

An intimate knowledge of local markets and execution capabilities is often the key determinant of success, due to the varied demand drivers and underlying real estate fundamentals across the region.

Figure 5: Varied Demand Drivers & Opportunities Across APAC

These unprecedented times present both challenges and opportunities, and will require institutional investors to make conscious investment decisions to rebalance and better future-proof their real estate portfolios. APAC’s indubitable continued growth story makes a well-grounded investment case, and this is an opportune time for investors to gain or increase exposure to the region.

Download(s)

--------------------------------

1. Projections by Oxford Economics as of June 2022.

2. The real estate market size of APAC tracked by MSCI was recorded at c.US$630bn as of 2020, up from c.US$386bn in 2010. The coverage ratio for APAC. was c.22% based on the estimated total market size of US$2.8tn in 2020. Source: MSCI, May 2022.

3. Projections by World Bank and Oxford Economics as of February 2022.

4. Includes tertiary sectors such as banking & finance, professional services, information technology, retail trade, healthcare, etc.

5. Projections by Oxford Economics as of June 2022.

6. Total returns in US Dollars.

7. Figure excludes development sites. Source: Real Capital Analytics, May 2022.

8. Includes business parks, data centers, logistics, tech parks, etc.

9. Refer to CLI Group Research’s Topical Paper – China’s Deleveraging Platform: Opportunities Ripe for Select Picking, June 2022.

10. Single Family Build to Rent.