The Journey to Net-Zero – Toward a Greener Investment Mandate

October 2022

Our take on the environmental sustainability challenges and opportunities in the real estate sector, and how investors should approach this rapidly evolving landscape

Five Perspectives on Sustainability in Real Estate

The importance of climate change and sustainability has been emphasized for decades, but it has become ubiquitous now in corporate agendas. The focus has since evolved to treat environmental sustainability in a more holistic and strategic manner, and on how to carve a strategic competitive advantage in the industry.

With regulations and standards becoming more stringent by the day, companies and investors are battling to comprehend the fast-changing dynamics. As we put on an investor lens to explore this specialized topic, we delve into the reasons for including sustainability in investment portfolios and the challenges that come along with it, and finally, how these sustainability related investments can drive bottom-line returns.

01 The Rise of Sustainability: Climate Change Has Become a Key Imperative for All Stakeholders

The impact of climate change is being felt by all, and the recent extreme weather events across geographies have brought the risks closer to home. This has galvanized stakeholders to double down on their climate action efforts and each of them has vital roles to play in the drive towards net-zero1 emissions.

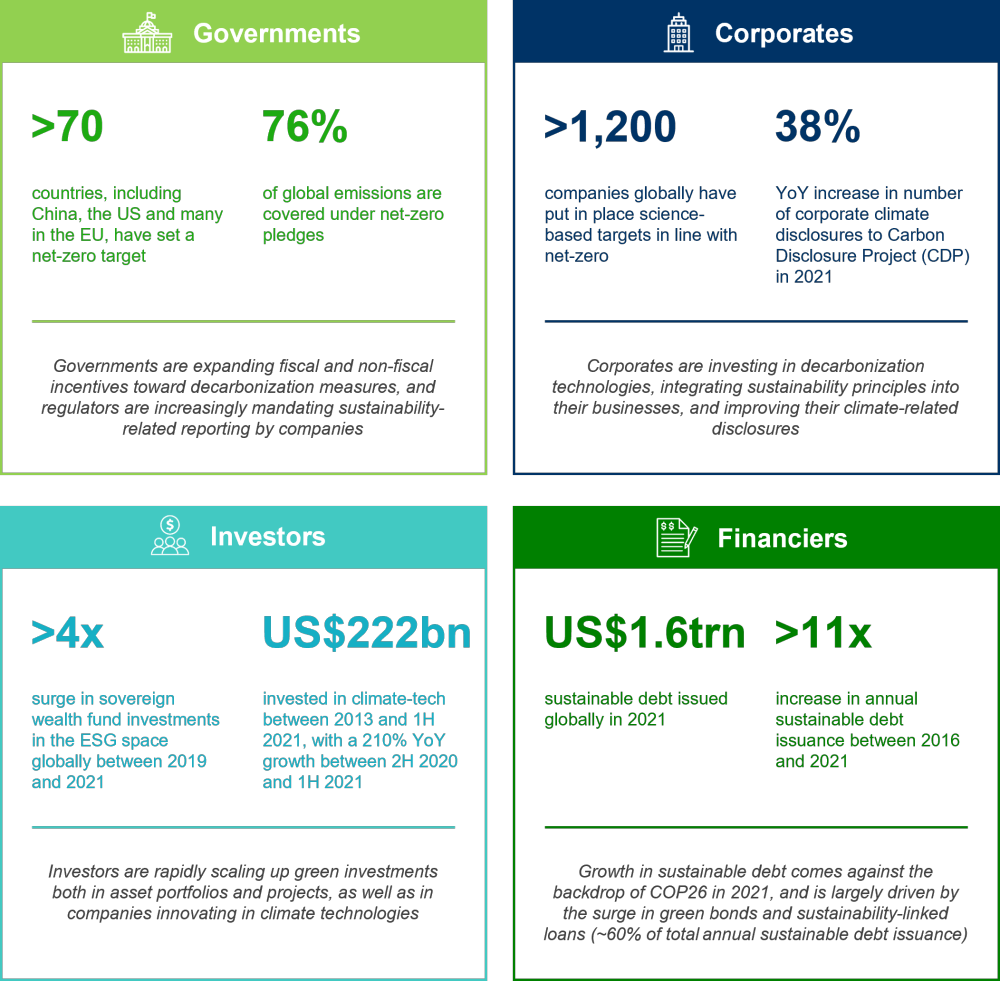

Key stakeholders, in particular – governments, corporates, investors and financiers, hold the collective influence to act on these net-zero commitments on a grander scale.

Every Stakeholder Has a Part to Play Towards More Sustainable Investments

Figure 1: Key Stakeholders’ Commitment and Action Items towards Net-Zero Goals

Greater Impetus for Corporates to Go Green

There are good reasons for real estate investment managers and portfolio operators to accelerate their green transition, including tighter regulatory and disclosure requirements, stricter national building codes, government incentives and grants, and increasing demands from tenants and investors.

Policy changes, in particular, have created an intrinsic disincentive toward not going green.

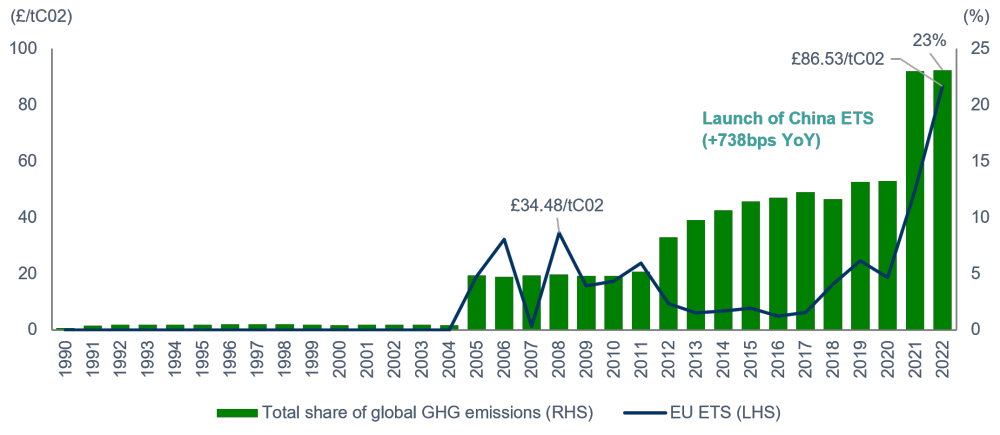

A case in point would be the globally recognized European Union’s Emissions Trading Scheme (EU ETS2), a key carbon3 pricing lever in the EU’s climate change policy, which has in the past two years4 surged 3.7 times against a 74% increase in the total share of global greenhouse gas5 (GHG) emissions covered by carbon pricing instruments (refer to Figure 2).

Figure 2: EU Carbon Pricing vs Share of Global GHG Emissions*

Carbon prices globally are expected to remain elevated, primarily due to the prevailing macroeconomic conditions, as well as the net-zero commitments of the EU and other regions. This provides a key financial impetus for the private sector to accelerate its decarbonization investments and avoid stranding of assets6.

In addition, tighter sustainability requirements from investors and end-users of real estate products have pushed owners and developers to hasten the pace of sustainability-driven initiatives.

02 The Built Environment is at the Heart of the Climate Change Crisis and Faces Key Challenges

Real Estate is the Single Biggest Contributor by Sector to Global Carbon Emissions

Buildings and Construction accounted for 37%7 of final energy and energy-related global carbon emissions – the single biggest contributor by sector. 27% of these come from building operations and 10% from building materials and construction. In comparison, Transport and Other Industries accounted for 23% each.

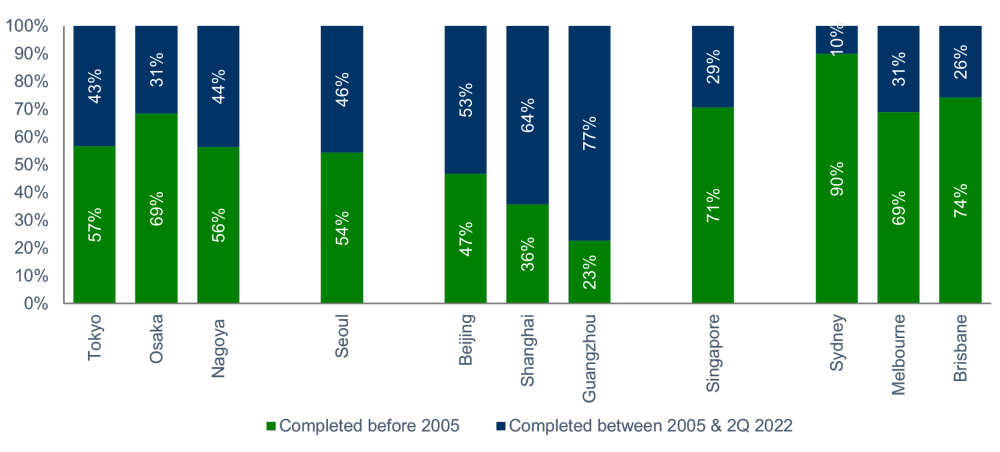

Moreover, older buildings (built before 2005) (refer to Figure 3) comprise 63% of prime office inventory in key developed markets across APAC (ex-China) alone, thus magnifying the issue at hand. In the global context, approximately half of the building stock today is likely to still be in use in 20508.

Figure 3: APAC Prime Office Building Age Profile – by City

As such, there is a need to focus on greening existing buildings which are here to stay, and not only on new builds – in fact, renovations and smart asset enhancements have a lower potential embodied carbon9 impact than new constructions and redevelopments.

Key Challenges for the Real Estate Industry to Pivot Toward Net-Zero

A. Balancing Environmental and Economic Goals

The overarching challenge to achieving sustainability targets is balancing the purpose-neutral10 financial goal versus the purposeful10 environmental goal.

Futureproofing investments and portfolio assets to become greener – via ground-up developments or refurbishments – can be costly and often requires heavy and chunky capital investments. Returns from many of these investments can take time to fructify and investors may be less inclined to commit green funding beyond what is mandated by regulations.

Going Green – Not Necessarily at Odds with Financial Returns

Despite these challenges, healthy financial returns can be reaped from going green and this is likely to continue to be driven by the following factors.

• Leveraging technology to increase efficiency in energy and water can yield tangible financial benefits (see case studies in Figure 5). In fact, investments in energy efficient innovations can provide a Return on Investment (ROI) in the range of 8-15%11.

• Producing renewable energy has become much more price competitive, with the price of solar modules having fallen by 90%12 over the past decade. Cost pressures in the industry should continue to alleviate going forward with the advancements in technology and green financing.

•Institutional tenants have begun to avoid buildings that do not meet their minimum green standards, resulting in longer leasing timelines and thereby negatively impacting investor returns.

•Corporates whose portfolios meet sustainability performance targets can access green financing, which traditionally come at more attractive financial terms.

•Companies that actively manage environmental risks can potentially enjoy better credit ratings, as credit rating agencies account for materiality of ESG13 in their rating assessments.

B. Aligning to Multiple Standards and Frameworks

With the proliferation of different reporting standards across jurisdictions, and various rating agencies using their own distinct methodologies to evaluate companies on their environment performance, it is becoming increasingly difficult for both investors and managers to compare funds and portfolios on a like-to-like basis.

C. Tackling Indirect (Scope-3) GHG Emissions

While some of the leading global fund managers and real estate operators are establishing targets and pathways for Scope 1 and 2 GHG emissions, progress on Scope 3 GHG emissions (indirect emissions primarily from tenants, embodied carbon and supply chain) which can account for majority of an organisation’s emissions, is proving to be far more challenging.

D. Other Challenges

Uneven Maturity of Climate-Tech solutions: Uncertainty on the technical and financial maturity of new technological solutions poses a practical challenge for portfolio operators in their selection of which solutions to back.

Greenwashing: Reputation risk from the perceived false impression of providing misleading information about how a company's products or policies are more environmentally sound.

Limited talent: Dearth of qualified and experienced sustainability professionals in the market.

Macroeconomic Environment: Geopolitical pressures and the prevailing macroeconomic conditions may threaten the pace of sustainability transition.

03 Holistic Approach is Needed to Address Key Challenges

It is important to first establish clear, accurate and comprehensive baseline environmental data, classifying these appropriately into the three GHG scopes for carbon emissions and getting this externally audited to ensure credibility. This must then be followed by outlining clear sustainability and net-zero goals through setting ambitious science-based targets that are externally assured and quantified. It is imperative to embed these targets and key sustainability principles throughout the real estate life cycle.

A three-step approach can be implemented to address the above challenges in the journey to net-zero.

A. Integrate a Credible Sustainability Strategy in the Entire Real Estate Lifecycle

i. Investments: Assessing the carbon, water and waste footprint of new investments against the sustainability targets, and integrating an internal carbon price at the investment stage ensures that sufficient capital expenditure is underwritten to avoid stranding of an asset.

ii. Design & (Re)development: New designs must incorporate sustainable development guidelines aimed for low energy and water consumption, and construction must include the experimentation with low embodied carbon materials and the use of onsite low carbon energy sources.

iii. Operations: Performance of the portfolio against sustainability key performance indicators (KPIs) must be regularly tracked, and technologies must be used to continuously improve the energy, water and waste efficiency of the asset.

Apart from these, sustainability targets and performance principles must be embedded in the organization’s policies, processes and balanced scorecards. Linking executive compensation to sustainability performance, for example, is fast becoming a key expectation from investors.

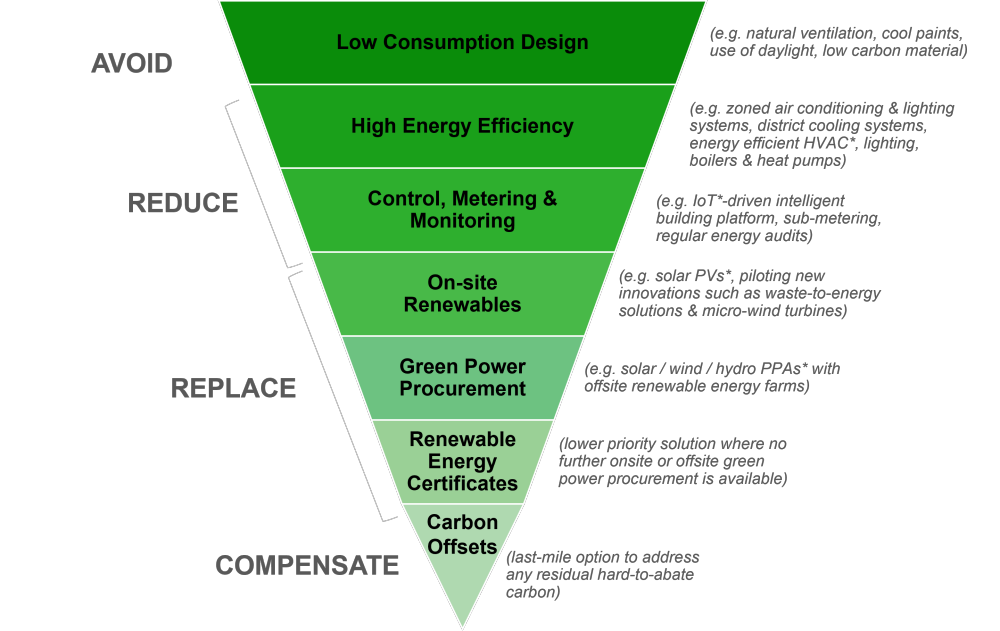

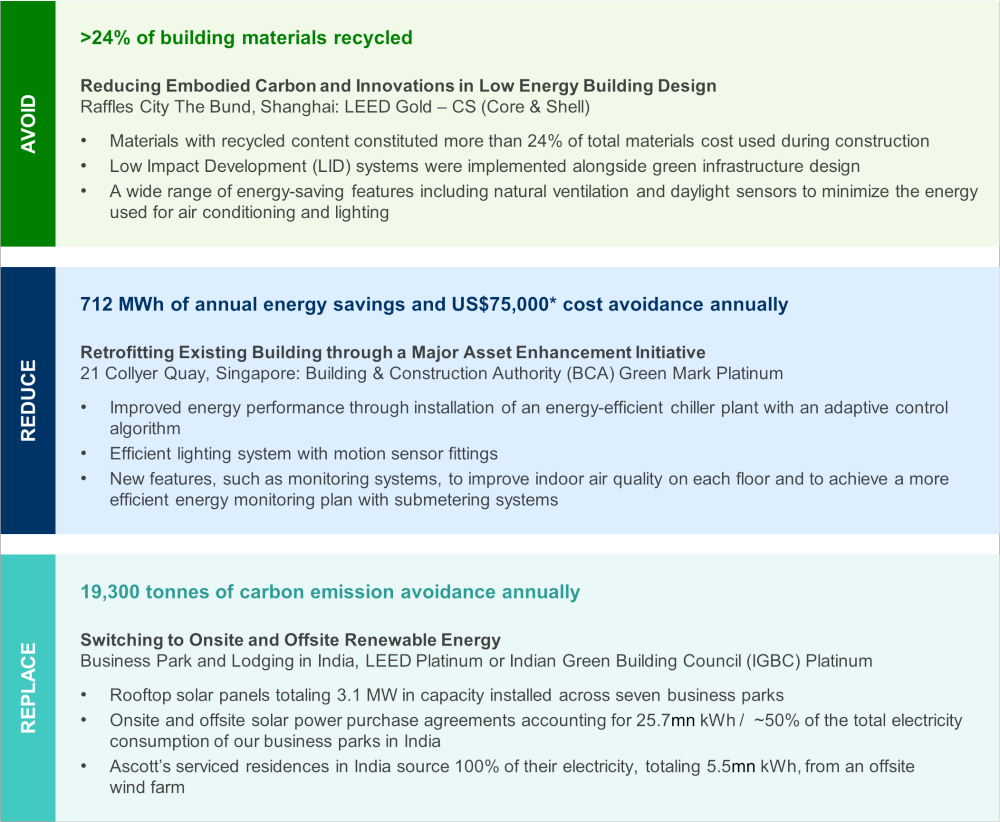

B. Create a Company-Specific Carbon Mitigation Hierarchy

It is essential to first recognize that each industry and even each company within the same industry has different business needs that vary across asset classes and geographies. They are also at different stages in their respective decarbonization journeys.

Determining decarbonization pathways is a critical step in translating net-zero plans into action and this is usually based on creating a Carbon Mitigation Hierarchy (CMH) (refer to Figure 4) – a blueprint for aligning corporate actions for climate change, serving as an internal guide for companies to prioritize their actions.

Real estate owners and operators must focus on investing in real decarbonization solutions targeting improved energy efficiency and expanding the sourcing of renewable power, and consider carbon offsets only as the last-mile option in their CMH.

Figure 4: Carbon Mitigation Hierarchy for the RE sector (non-exhaustive)

Figure 5: Proprietary Case Studies

Innovative climate technologies will play a critical role in driving the industry towards net-zero, and real estate operators should source globally for cutting-edge innovations to pilot across their portfolios for meeting their environmental targets. The industry today is replete with start-ups and growth companies with proven technologies ranging from automation of environmental data tracking to using artificial intelligence for energy efficiency gains, and these present additional investment opportunities.

C. Develop Rigorous Monitoring, Reporting and Governance Mechanisms

Global Recognitions Build Trust in the Market

Aligning to international frameworks like Global Reporting Initiative (GRI) and Task Force on Climate-related Financial Disclosures (TCFD) will elevate a corporate’s positioning within the market and the sustainability community. This will pave the way toward inclusion in renowned indices such as the Global ESG Benchmark for Real Assets (GRESB), Dow Jones Sustainability Indices and Morgan Stanley Capital International (MSCI).

Inclusion in these indices is a sign of strong sustainability maturity and ambition, and many financial institutions increasingly peg their sustainability-linked loan terms to performance on these indices.

However, mere alignment to frameworks is not enough – it is important to demonstrate and publish regular progress on sustainability KPIs against both short- and long-term targets, and explain any deviations in a transparent manner.

Further, setting up the right sustainability governance structure within all parts of the organization – including how the Board of Directors is a steward of a company’s sustainability strategy and performance – is the foundation to strengthen credibility in the market

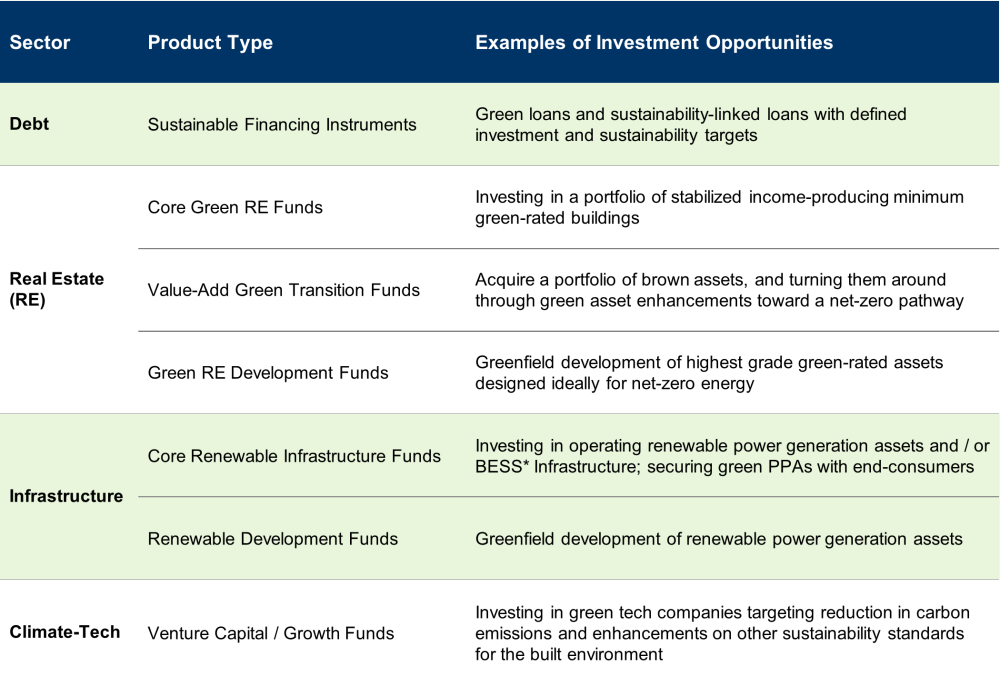

04 Investors Can Look Forward to a Rapidly Evolving Opportunity Landscape as the Industry Powers Ahead to Net-Zero

In order to reach net-zero emissions by 2050, US$275trn14 in global annual capital investments is needed, or US$9.2trn14 per annum (p.a.) on average. Of this, about US$1.7trn p.a. will be needed by the real estate sector alone. Most of these investments in buildings target the two main decarbonization levers of energy efficiency (including digitalization and smart controls) and green electrification.

Figure 6: Green Investment Opportunity Set (non-exhaustive) – Options are Aplenty

Bridging the Funding Gap to Present Diverse Green Investment Opportunities

The need to bridge the funding gap will drive the sustained emergence of investment opportunities across varied product types. This will provide investors viable options to make sensible decisions to rebalance and future-proof their existing portfolios, with an aim to meet their long-term sustainability goals. The transition to a greener economy will present an enlarged pool of viable opportunities for institutional investors with varied risk appetites and across the capital stack.

More importantly, extracting the most value out of these opportunities will depend significantly on forming the right partnerships. Investors will need to partner with fund managers and asset operators that have the right balance of sustainability ambition, track record of successfully delivering value, ability to pilot new decarbonization solutions at scale, accreditation by globally renowned sustainability frameworks and a reputation of being a trustworthy partner.

05 Evolving Sustainability Landscape requires Flexibility and Dexterity

The key is to make consistent progress with quantifiable science-based targets and produce tangible and credible results.

The sustainability landscape is an ever-evolving one, with the added complexity of the prevailing macroeconomic environment.

As the real estate sector’s net-zero journey evolves, responsible companies committed to climate change should demonstrate dexterity and flexibility to provide for multiple paths to get to their targets. There is unfortunately no silver bullet and there is a need to constantly experiment with multiple solutions in parallel.

The key is to make consistent progress with quantifiable science-based targets and produce tangible and credible results. While sustainability frameworks, standards, technologies and stakeholder expectations are transforming at a rapid pace, companies should continue to press forward notwithstanding uncertainty or ambiguity.

Being proactive in the journey to net-zero is thus necessary at all means.

Download(s)

--------------------------------

1. Net-zero means cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere, by oceans and forests for instance. Source: UN official website.

2. The EU ETS is a “cap and trade” scheme where a limit (the cap) is placed on the right to emit specified pollutants over a geographic area and companies can trade emission rights within that area. The EU ETS has tackled GHG emissions with a reported 35% reduction between 2005 and 2019, with further reduction estimated by 2030 (between 41%-48%) and 2040 (55%-62%) relative to 2005. Source: Environmental Protection Agency (EPA) official website, EU official website, Europe Environment Agency, January 2022.

3. Carbon Dioxide is referred to as Carbon in this paper.

4. From April 2020 to April 2022.

5. Greenhouse gas (GHG) comprises Carbon Dioxide, Methane, Nitrous Oxide and Fluorinated Gases; Carbon Dioxide is the largest component of GHG. Source: Center for Climate and Energy Solutions.

6. Assets that have suffered from unanticipated or premature write-downs, devaluations or conversion to liabilities. Source: UN Environmental Programme official website.

7. Global Alliance for Buildings and Construction 2021 Global Status Report.

8. International Energy Agency – Energy Technology Perspectives 2020.

9. Carbon emissions associated with materials and construction processes throughout the whole real estate lifecycle.

10 .Term referenced from The World Bank & J.P. Morgan’s report “A New Dawn – Rethinking Sovereign ESG”, 2021.

11. Based on CapitaLand Investment’s experience and achieved results.

12. Source: PVInsights.

13. In relation to materiality of ESG in assessing corporates’ credit ratings. Source: Fitch’s “ESG Relevance Scores for Corporates”, Moody’s “Approach to Assessing ESG in Credit Analysis”, S&P’s “Materiality Mapping: Providing Insights Into The Relative Materiality Of ESG Factors”.

14. From 2021 to 2050. Source: McKinsey & Company’s “The net-zero transition”, January 2022.