Serviced Residences (& Co-Living) Becoming a Mainstream Investment Asset Class

September 2022

Five Perspectives on the Serviced Residence Sector

The ongoing evolution in global demographics, coupled with new mobility and living megatrends spurred on by the onset of the Covid-19 pandemic, has raised the profile of the living sector and has led to changing consumer preferences, as well as increased investor interest and transaction volume in select living sector products.

The long-term fundamentals of the Serviced Residence (SR) sector (including Co-living) and the resultant resilient traits exhibited over the Covid-19 pandemic present a compelling option for institutional investors looking at the living sector.

In addition, the SR sector is strategically positioned to offer attractive total returns, particularly in Asia Pacific (APAC) where the sector is more prevalent, underpinned by clear long-term demand drivers including the recovery of international travel, and near-term tactical tailwinds with guests’ stronger preference for trusted brands.

01 Introducing the Universe of Living Sector Products; Various Nuances Exist

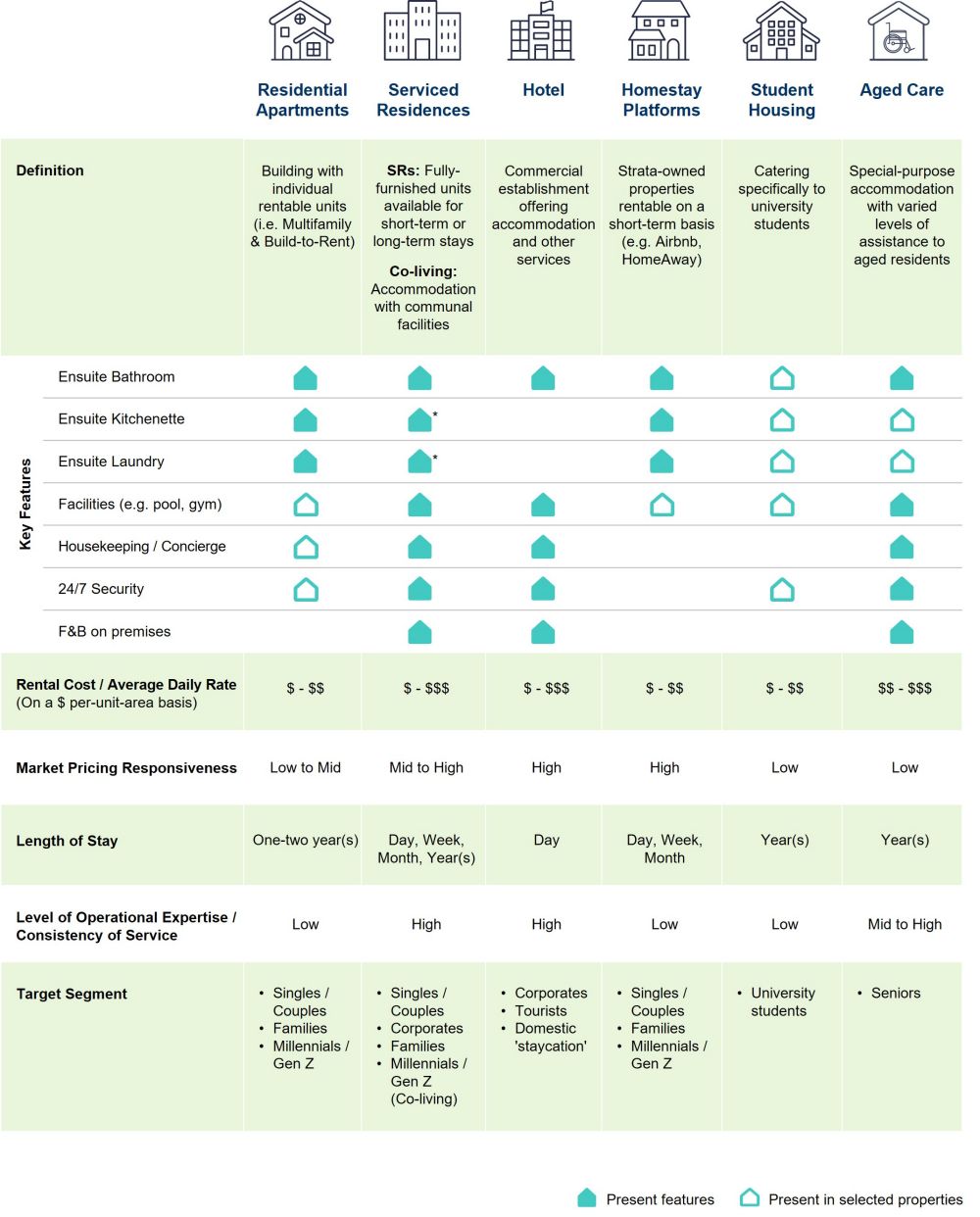

The living sector – which refers to properties that provide accommodation for individuals across all stages of life – includes a multitude of assets, each with their own set of characteristics, including target segments and varying lengths of stay, as indicated in Figure 1.

Whilst Student Housing and Aged Care products are conceived for a very specific demographic, other living sector products are more broad-based. Residential Apartments address long-term accommodation needs and target singles, couples and families. On the other hand, Serviced Residences (SRs), Hotels and Homestay Platforms address different accommodation needs. SRs mainly cater to corporates, families, and leisure travelers seeking more space for longer term stay, while Hotels and Homestay platforms mostly cater to more transient guests including tourists.

In response to evolving demographics and consumption patterns, the living sector has witnessed the emergence of new innovative concepts, such as Co-living and micro-apartments, which help to address the challenges of home affordability and availability in metropolitan cities.

These concepts present an alternative solution to bridge these gaps for individuals across all walks of life without having to compromise on the overall quality of stay.

Figure 1: Living Sector Universe – Products Overview

02 A Look into the Serviced Residence Segment (including Co-living)

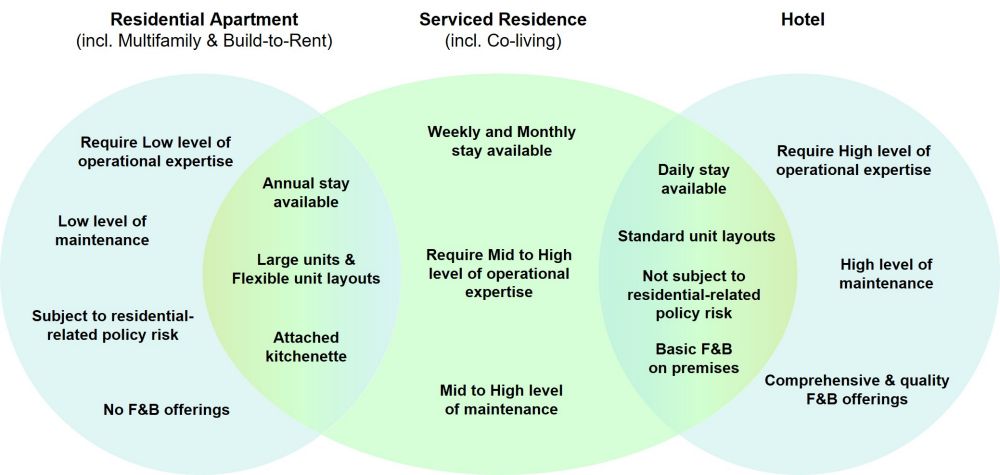

SRs, also commonly referred to as “Aparthotels” or “Extended Stay”1 can be considered as a hybrid between Residential Apartments and Hotels with the key differences between these segments highlighted in Figure 2.

SRs typically have lease terms which offer higher flexibility, with units sold daily, monthly or yearly, as compared to Residential Apartments, which are typically leased on a one-to-two-year basis, and Hotels where rooms are sold daily and are largely dependent on seasonal demand. As such, SRs have the flexibility to sell more long stays in a down-cycle to provide income resilience whilst also promoting more short stays in a high-demand environment to participate in further income upside.

Figure 2: Differences between a Residential Apartment, Serviced Residence and Hotel

Serviced Residences vs. Hotels

Both SRs and Hotels are competitive in their price points, although the value propositions for each are different. SR properties may also offer highly curated in-stay guest engagement programs which are typically not found in Hotels.

SR units are more spacious and are typically 10-40%2 larger in size than Hotel rooms. With less space allocated to typically lower-utilized facilities, such as convention halls and ballrooms, an SR can provide for larger unit sizes and flexible unit layouts (e.g. studio to 3-bedroom) which allows for the inclusion of ensuite or in-room amenities such as a fully equipped kitchenette and washing machine. The larger units in SRs are more conducive for longer stays with guests that stay on an extended basis making up a considerable proportion of an SR’s guest base.

In some cases, there are individuals and families that opt to stay for several years, which may also point to SRs (& Co-living) being seen as an alternative form of permanent residence.

From a development perspective, Hotels run higher investment costs compared to SRs and Residential Apartments due to the higher costs for interior renovation and mechanical & electrical services (M&E). Similarly, from an operational standpoint, the level of maintenance and running costs required for Hotels are generally higher than those for SRs and Residential Apartments.

Serviced Residences vs. Residential Apartments (Multifamily sector)

Although Residential Apartments (Multifamily sector) hold many of the same key features as SRs, several differences between the two products exist. Multifamily leases are typically fixed on an annual basis, compared to SR leases which offer greater flexibility of terms with daily, monthly, and annual rates. The longer WALE (weighted average lease to expiry) of Multifamily leases may therefore limit any adjustments to rental rates, running the risk of having no upside or a tailed-off upside in an inflationary environment.

Notably, the level of operational expertise required for Multifamily is lower compared to SRs, where the capability of the operator is highly influential on the overall asset performance. This renders less branding opportunity for Multifamily and is a further factor compressing any potential rental upside.

In addition, due to its Residential classification, the Multifamily sector may be subject to residential-related policy risk (e.g. rent control) in many countries.

Co-living Hits the Sweet Spot for Millennials

and Gen-Z

Co-living, while sharing similar owner-operator business models with SRs, offers slightly different features. The product offering is smaller in size compared to SRs, with typically less in-room amenities, and more shared facilities such as a social kitchen and co-working spaces in common areas.

The Co-living concept is designed with the Millennial or Gen-Z in mind. Although the market is a relatively nascent one, demand is growing. The Covid-19 pandemic has spurred a new way to live and work, with a shift toward more experiential preferences. Co-living properties provide a sweet spot for this target segment to experience a community living lifestyle at a more competitive price point as compared to SRs and Hotels.

Investment Merits of Serviced Residences and Co-Living

The intrinsic traits of SRs and Co-living contribute to the resilience and attractiveness of the asset class, underpinned by the following:

- Higher operating margins due to lower overheads and higher contribution of room revenue (compared to ancillaries such as F&B and convention facilities)

- Ability to exhibit rent maximization in a strong market or peak season, due to its hybrid nature and ability to calibrate higher pricing from shorter stays

- Not being subject to rent control or residential-related policy risk

- Having a diverse customer profile ranging from corporate guests to families and young professionals

- Offering flexible accommodation providing for:

- Different lengths of stay ranging from daily, weekly, monthly to yearly

- Different unit types from studio to 3-bedroom, with more in-room amenities

- A range of price points for different curated brand experiences

"Serviced Residences offer a superior business model with diverse demand drivers"

03 Promising Macro Fundamentals to Underpin Long Term Growth Potential of Serviced Residences in APAC

Countries across the globe are further relaxing Covid-related restrictions and re-opening borders, with the US and Europe currently in the lead. APAC markets are expected to progressively follow on, with the trend underpinned by select structural demand drivers across the region.

Sustained Robust Foreign Direct Investment (FDI) Growth

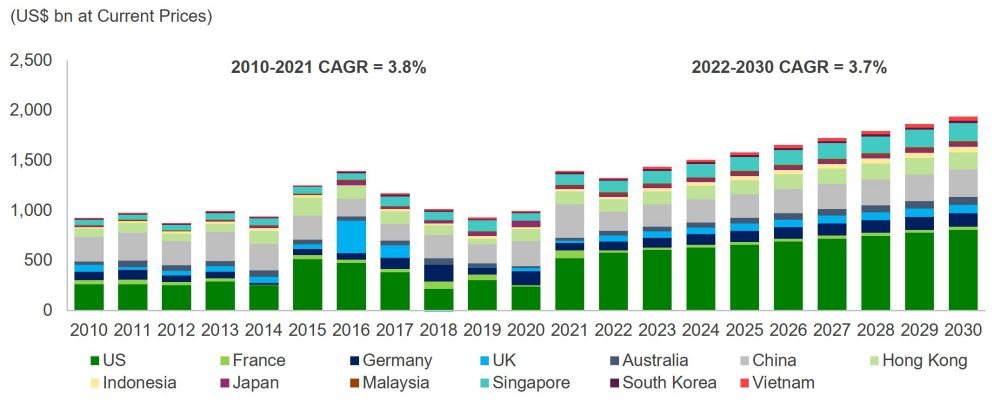

FDI into major countries and key metropolitan cities is projected to continue its current growth trajectory, at a compounded annual growth rate (CAGR) of 3.7%, from 2022 to 2030 (see Figure 3), and should continue to underpin corporate long-stay and business travel demand going forward.

Figure 3: Foreign Direct Investment (Inward) − By Country

Enlarged Demand Base Supported by Favorable Demographics, Led by APAC

Total population in APAC is expected to grow at a CAGR of 0.6%3 (+216mn) from 2022 to 2030 (Advanced Economies4: 0.3%3 CAGR, +25mn). Notably, the working-age population5 is expected to comprise more than half of this increase (+119mn)

in APAC.

Middle class population6 spending is projected to grow at a CAGR of 2.0%, equivalent to a US$2tn annual increase, through to 2030. This group of consumers can afford more non-essential goods and service luxuries, including travel, hospitality, recreation, and personal care, compared to the less affluent.

Return of International Travel and Continued Trend of Domestic Travel

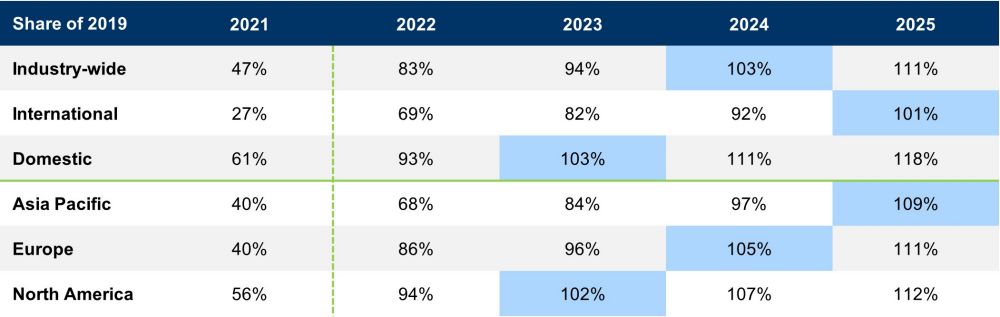

International travel is set to see a sharp rebound on the back of the re-opening of international travel lanes and increased vaccination rates, with certain regions projected to reach 2019’s level as early as 2023 (see Figure 4).

Recovery will be uneven across the regions, with APAC only projected to surpass 2019’s level by 2025. However, upside from domestic travel is expected to be the reigning travel trend7 in APAC, amongst all regions, and should cushion any shortfall in international arrivals.

Figure 4: Passenger Number Projections (2021-2025)

Expected Increase in Global Workforce Mobility and Relocations

The prolonged “work-from-home” or “work-from-anywhere” setting during the Covid-19 pandemic has allowed many corporates and employees to be acclimatized and more receptive to remote-working, potentially bringing on an increase in workforce mobility.

This allows for the possibility of employees being able to work on virtual assignments or work virtually while travelling, blurring the lines between leisure and business travelers. At the same time, the ongoing “Great Resignation”8 spells competition for talent and could potentially drive domestic relocations9.

04 Serviced Residences (& Co-living) are Strategically Positioned to Benefit from Sector Tailwinds

The anticipated post-pandemic cyclical recovery for the global and APAC travel industry presents a clear runway for the hospitality sector and particularly SRs, supported by the long-term structural demand growth drivers and near-term tactical tailwinds underpinned by a stronger preference for trusted brands and longer travel duration.

Serviced Residences Outshined in the Covid-19 Era, Showcasing Resilience and Defensiveness

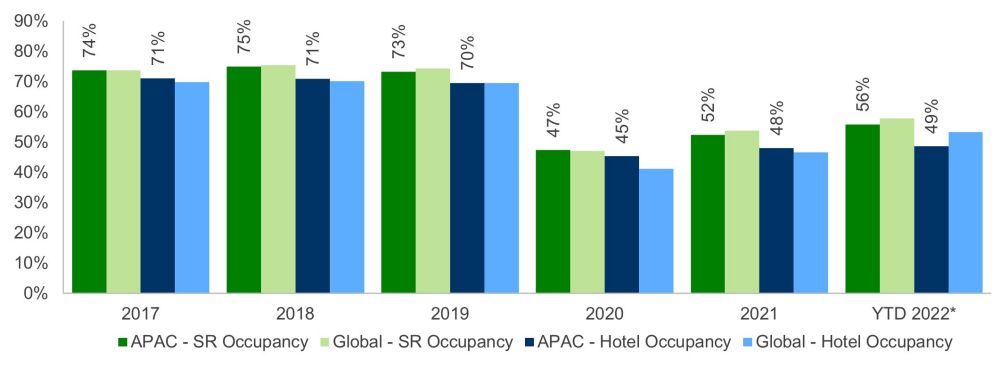

The resilience of SRs can be evidenced by their higher occupancy10, most notably at the height of the Covid-19 pandemic in 2020, where occupancy levels in both APAC (47%) and globally (47%) surpassed their Hotel counterparts (see Figure 5).

Figure 5: Occupancy in SRs10 vs Hotels (APAC vs Global)

Occupancy remained stronger in SRs through the first half of 2022, standing at 56% in APAC (Hotels: 49%) and 58% globally (Hotels: 53%), and is expected to gradually normalize to pre-Covid levels of greater than 70% in tandem with the projected recovery in international travel.

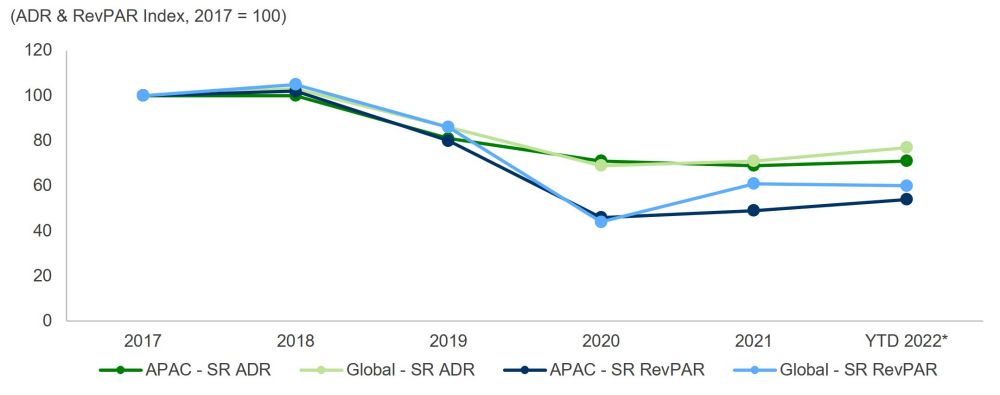

Asset performance indicators for SRs are already pointing to a recovery, exhibited by the increases in revenue per available room (RevPAR) through the first half of 2022 (see Figure 6). RevPAR for SRs globally rose 17.1% year-to-date (YTD)11, after posting a 17.7% year-on-year (YoY) increase in 2021. Over the same periods, SRs in APAC recorded an increase of 10.3% YTD11, following a 7.2% YoY rise in 2021.

SRs’ resilience is further evidenced by the emergence of select markets – including France, Spain and the UK – surpassing their respective pre-Covid RevPAR levels (2017-2019 average) as at June 2022, largely driven by the easing of travel restrictions and resumption of international travel.

Going forward, SRs in APAC should benefit from the further lifting of Covid-19 related restrictions and the re-opening of borders, the progress of which has been lagging that of their counterparts in the US and Europe.

Figure 6: SR10 ADR & RevPAR Indices (APAC vs. Global)

(ADR & RevPAR Index, 2017 = 100)

SRs and Extended Stay1 Assets saw Robust Investor Interest throughout the Covid-19 Pandemic

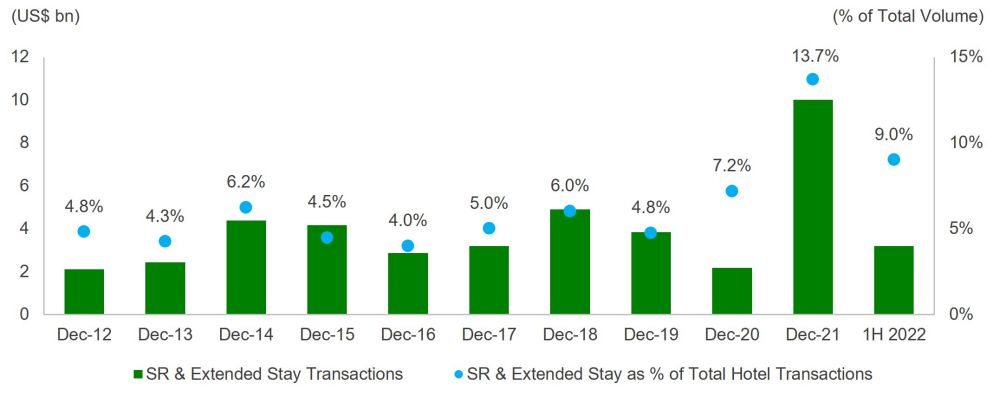

There has been renewed focus on SRs and Extended Stay1 assets during the pandemic from institutional investors, who were largely attracted by the resiliency of these products. Total transaction volume surged 358% YoY to a new high of US$10bn in 2021 (see Figure 7), led by Blackstone’s and Starwood Capital’s purchase of the Extended Stay America chain for US$6bn in June 2021.

The pair subsequently bought another portfolio in the US – WoodSpring Suites properties – from Brookfield Asset Management for US$1.5bn in February 2022. This brought the total transaction volume in 1H 2022 to US$3.2bn, which already surpassed the full-year figure recorded in 2020.

In addition, The Ascott Limited acquired Oakwood Worldwide, a premier global serviced apartment provider, from Mapletree Investments in July 2022 for an undisclosed amount.

As investor interest in SRs and Extended Stay assets has grown in recent years, these asset classes are becoming increasingly institutionalized, with investors now having a wider array of exit options in the form of private equity real estate funds, private family offices, listed real estate investment trusts (REITs) and business trusts, to name a few.

Figure 7: Global Transaction Volume − SR & Extended Stay

Co-living among Investors’ Choice of Hotel Asset Conversions

The conversion of Hotel assets has been an emerging trend, with 27%12 of Hotel investors in APAC through the first half of 2022 (2015-2021 average: 7%) intending to either convert or demolish these assets to other uses. For instance, investors seek to convert these assets into offices or apartments, with Co-living apartments being a popular choice in Hong Kong and Singapore13. This represents a shift in demand drivers, as demographic changes bring along a different set of guest preferences.

05 Other Key Considerations Investors should be aware of

Investors should be cognizant of potential downside risks despite the generally positive outlook for the travel sector.

Potential Persistent Headwinds for the SR and Co-living Sector, including: (i) the re-emergence of new variants of Covid-19 or other contagious diseases; (ii) incremental competition from entry of new SR operators and private homestay platforms, as well as new brands from major Hotel groups; and (iii) operator profit margin compression due to elevated expenses from rising cost of goods, energy prices and payroll.

Choice of Operator is Essential: The above mentioned risks can be mitigated by having a key operator in place. In a post-Covid world with evolving traveler and guest preferences, the need for a trusted operator and brand is paramount,

now more than ever, with a heightened emphasis on factors such as duty of care in sanitation standards, sustainability, wellbeing, digitalization and personalized services, safety, and security.

Owner-operator Model Calls for Outsized Reliance on Trusted Brands: Operator companies are the backbone of SRs and Co-living properties, and the success of these investments largely rides on the reputation and execution capability of the operator. Brand recognition is key to a growing customer base, and operators with strong expertise – particularly in local markets – and more established customer networks will be the top contenders in this space. The choice of operator is thus increasingly critical in delivering customer satisfaction and optimal asset performance.

"Supported by strong long-term fundamentals and the resilient traits demonstrated over the Covid-19 pandemic by the sector, SRs (& Co-living) are strategically positioned to offer attractive total returns in APAC underpinned by the anticipated cyclical recovery in the regional hospitality and travel industry."

Opportunities Abound - Promising Tailwinds in APAC

The recovery of the travel sector has a global spillover effect, and this points to tailwinds across all regions, contingent on border re-openings and the state of the post-Covid recovery.

Over the next few years, the anticipated cyclical upswing is expected to propel an uptick in investment total returns, underpinned by the gradual recovery in occupancy and average daily rates (ADRs) to pre-Covid levels. The current early-stage cyclical rebound presents a compelling opportunity for institutional investors to strategically rebalance their portfolio to benefit from the potential upside.

Regionally, APAC provides further promise for the following reasons:

(i) the region is expected to continue to attract incremental inward FDI, exhibited by the robust projected growth rates in key markets (e.g. Australia, Singapore, Vietnam) through 2022-2030 which should help drive corporate long-stay demand; and

(ii) enlarged potential demand base with working-age population growth in APAC outpacing that of all advanced economies4, and a further boost from middle class population growth.

Download(s)

--------------------------------

1. Extended Stay assets refer to long-term accommodation for guests and include amenities such as ensuite kitchenettes and laundry. Extended Stay, Aparthotels, Serviced Apartments and Serviced Residences are used interchangeably across geographies.

2. Based on sample comparisons between selected SR units owned by The Ascott Limited and comparable Hotel rooms with the same ratings, similar price points and within the same respective districts in selected regions.

3. Oxford Economics, June 2022.

4. Refers to 34 economies including Australia, France, Germany, Hong Kong, Japan, Singapore, South Korea, the US and UK.

5. Working-age population are those between 15-64 years old. Source: World Bank, Oxford Economics, June 2022.

6. Those with incomes of US$12 to US$117 per day per household, adjusted for purchasing power parity. Source: The Geography of the Global Middle Class: Where They Live, How They Spend – Visa, Oxford Economics, May 2022.

7. United World Tourism Organisation (“UNWTO”) Panel of Experts, January 2022 survey.

8. Term coined by Professor Anthony Klotz, University College London School of Management, describing an economic trend where employees voluntarily resign from their jobs en masse – current possible causes include wage stagnation, job dissatisfaction, safety concerns of the Covid-19 pandemic, and the desire to work for companies with better remote-working policies.

9. Worldwide ERC, May 2022.

10 .SR data is procured from The Ascott Limited’s proprietary database; no adjustments are made for stabilization periods for new properties and properties in emerging cities and frontier markets with typically lower Average Daily Rates (ADRs) and occupancy. Global figures capture The Ascott Limited’s data across APAC, EMEA and US and is therefore disproportionately weighted towards APAC.

11. As at 30 June 2022.

12. Real Capital Analytics Asia Pacific Capital Trends 2Q 2022, August 2022.

13. CBRE 2022 Asia Pacific Hotels Outlook, March 2022.