Catalyst for Change - Commercial Real Estate Private Credit in Asia Pacific

August 2023

Private credit in commercial real estate (CRE) has become an essential component of an investment portfolio in the prevailing economic environment, exacerbated by tighter liquidity and elevated interest rates. Traditional lending institutions have become cautious in an increasingly restrictive regulatory environment and private credit has filled the void by offering creative capital solutions to businesses and individuals.

ACCESS AND FLEXIBILITY ARE CRUCIAL

Borrowers increasingly prioritise access and flexible terms covering liquidity and repayment over headline interest rates. Capital constraints and tightening regulatory regimes are weighing on traditional lenders, driving businesses and individuals towards alternative financing sources. Growing capital gaps, with a multi-year low in Loan-to-Value (LTV) limits1 and the highest mortgage rates2 since the global financial crisis, have further accelerated this shift.

In this evolving landscape, private credit has emerged as a vital solution, providing tailored financing options which meet the evolving needs of borrowers in the current challenging macroeconomic and capital market environments.

Simultaneously, private credit in CRE is gaining recognition as an important asset class and is an appealing option within institutional investor portfolios, functioning as a hedge or complement to existing exposures. Its unique investment characteristics, including potentially higher yields, downside protection, and reduced susceptibility to market volatility, make it an attractive asset class for diversification and enhanced risk-adjusted returns.

Especially within the Asia Pacific region (APAC), Australia stands out as a compelling market, distinguishing itself among other noteworthy destinations such as South Korea (S.Korea), Japan, India and China.

THE CRE PRIVATE CREDIT UNIVERSE

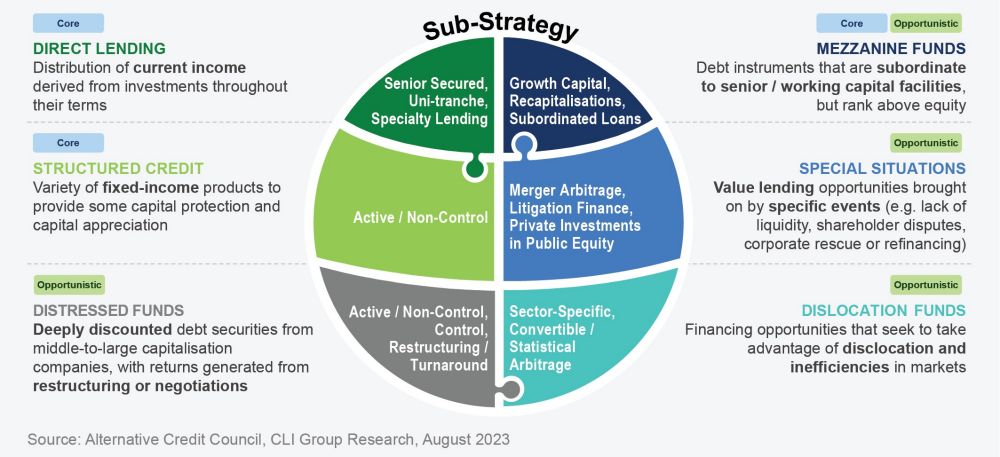

The global private credit market has experienced tremendous growth in the past five years, more than doubling in size3. CRE private credit strategies can be classified into two broad categories:

1. Core: Investors in this category receive regular and predictable cash flows, according to the agreed contractual terms. Interest payments are backed by income-producing and core development collateral;

2. Opportunistic: Investors in opportunistic strategies are exposed to distressed borrowers who are struggling to meet financial obligations. The purpose is to gain control and increase the value of debt (such as through operational restructuring or negotiations) and further explore upside via equity ownership.

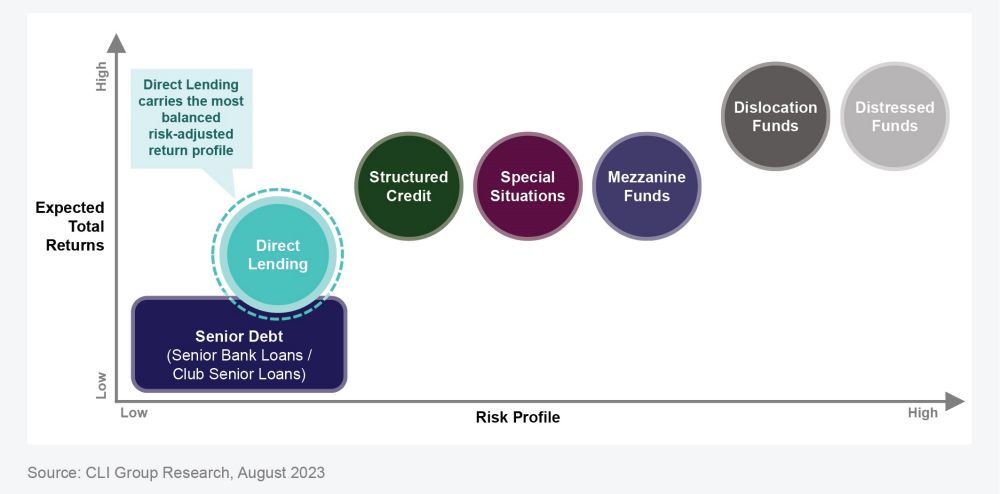

There is a wide range of private credit strategies (Figure 1) under these two categories, each varying in risk-return profiles (Figure 2), levels of seniority and structural features. When making decisions in this space, investors should carefully consider these strategies based on their specific investment goals, time horizon, risk tolerance and inherent characteristics.

Direct Lending is the most popular strategy within the Core category, with close to half3 of the global private credit market currently allocated within this area, because it is the most straightforward and can plug the credit gap directly. Direct Lending is very much relationship-based and enables lenders to develop a more nuanced understanding of borrowers’ business and financial positions, thereby facilitating enhanced support beyond capital provision. Another strategy within the Core category is Structured Credit, which includes fixed-income like products and products with additional upside.

In the rapidly evolving APAC private credit space, Direct Lending stands out as the preferred strategy for institutional investors. It allows them to navigate and gain familiarity with the diverse jurisdictions across the region without having to move up the risk curve to establish relationships with relevant managers and local networks.

Figure 1: Summary of CRE Private Credit Strategies

Figure 2: CRE Private Credit Local Currency Total Returns Spectrum in APAC – by Strategy

CASE STUDY: CRE PRIVATE CREDIT IN AUSTRALIA

PROMISING OPPORTUNITY FOR CRE PRIVATE CREDIT

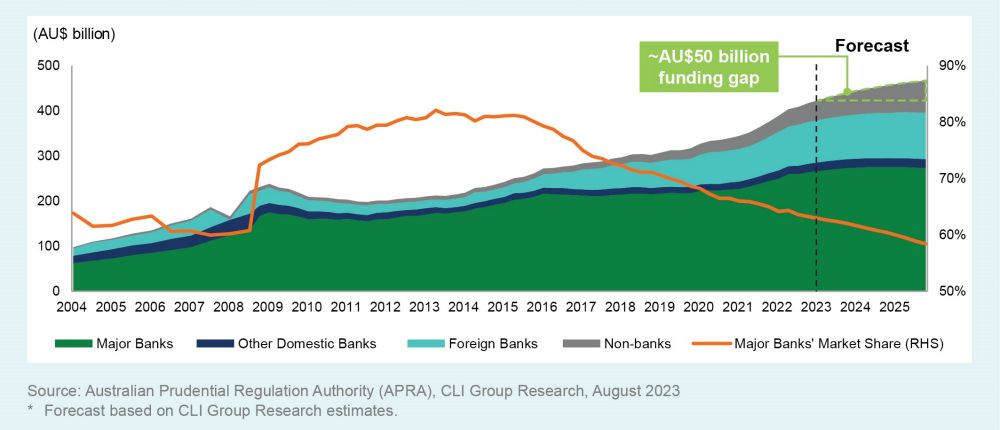

CRE loans in Australia has experienced a surge in recent times, to AU$375 billion (+10% YoY) in 20224, its largest increase in seven years. At the same time, an estimated AU$50 billion5 funding gap is emerging (Figure 3), as regulatory pressures progressively weigh on banks and lending requirements tighten, increasing opportunities for the underserved CRE private credit sector, especially in the Direct Lending segment.

Private credit has gained traction among investors in Australia seeking higher returns and diversification, driven by a growing emphasis on stable and predictable income streams amidst a market characterised by elevated volatility and uncertainty. With traditional investment options struggling to provide consistent yields, CRE private credit has emerged as an attractive alternative that offers potential risk mitigation.

Moreover, private credit plays an instrumental role in fostering the growth and development of various commercial properties, including offices, hotels, logistics facilities, as well as build-to-rent and purposebuilt residential complexes. The flexibility and tailored approach of private credit lending enables it to cater to the specific needs of these diverse real estate ventures.

Figure 3: CRE Exposure by Lender Type in Australia (2004-2025F*)

WHY INVESTORS LOOK TOWARDS APAC PRIVATE CREDIT

Potential Diversification Benefits from CRE Private Credit Exposure

- In tandem with the institutionalisation of the CRE private credit market, allocations to this sector will become more mainstream and made more accessible with advancements in the CRE sector. Investors looking to add private credit to their portfolios can look towards a wider cyclical opportunity set with credit capability, which could enhance risk-adjusted returns.

- In addition, sustainability is a pervasive consideration, which extends throughout the various layers of capital allocation. When it comes to credit, investors will be inclined to enhance their involvement in this realm.

While the APAC CRE private credit market is still in its early stages, the implementation of consistent due diligence and credit enforcement systems has created opportunities for further expansion. This growth is supported by the existing demand-supply gap and the relatively low allocation to private credit in the APAC region.

Download the full research report to explore the CRE Private Credit market in APAC and why it is an attractive asset class for diversification and enhanced risk-adjusted returns.

Download(s)

----------------------------------------

- LTV for commercial assets were only slightly over 50% in May 2023 (Dec’19: 66%), the lowest since end-2009 – using transactions in the US as a benchmark. In APAC, average LTV ratios declined to 55% from 60% in South Korea, and to 50% from 55% in Australia, over the past 24 months. Source: MSCI, CBRE, May 2023.

- Commercial mortgage rates experienced spikes in 2022 and rose to 6.7% in May 2023 (Dec’19: 3.9%), the highest since mid-2010 (prior to 2020) – using transactions in the US as a benchmark. The cost of debt has increased across the board in APAC, from 2-3% to 5.5-6.0% over the past 24 months. Source: MSCI, CBRE, May 2023.

- Total Private Debt Assets under Management (AUM) grew 137% from end-2017 to US$1.47 trillion in end-2022, of which 46% is allocated within Direct Lending. Source: Preqin.

- APRA, March 2023.

- Based on CLI Group Research estimates.