Finding Opportunity in Volatility within Asia Pacific - Reprioritising Fundamentals in Challenging Times

June 2023

As we approach the midpoint of the year, volatility continues to make its mark on markets and investors worldwide. But there have been some glimmers of hope as global headline inflation has started to ease as a result of declining energy and food prices.

The global outlook for the year ahead is expected to be marred by a slowdown in GDP growth, a continued rise in interest rates and a more targeted approach by many governments in fiscal support measures.

Turning Volatility into Opportunity: What’s on the Investment Menu in APAC?

The macroeconomic climate is shrouded in uncertainty, but a closer look at Asia-Pacific (APAC) against this backdrop reveals myriad opportunities for various risk appetites and investment horizons. Now is a judicious time for investors to review, recalibrate and diversify sector allocations within their global real assets portfolio to counter implicit market risks and the impact of the denominator effect.

So, how can investors benefit from ongoing cyclical and secular trends across APAC?

As long as interest rates are high and return enhancers are low, investors should take a renewed focus on market fundamentals and assess prospective investments through a clear lens of opportunity:

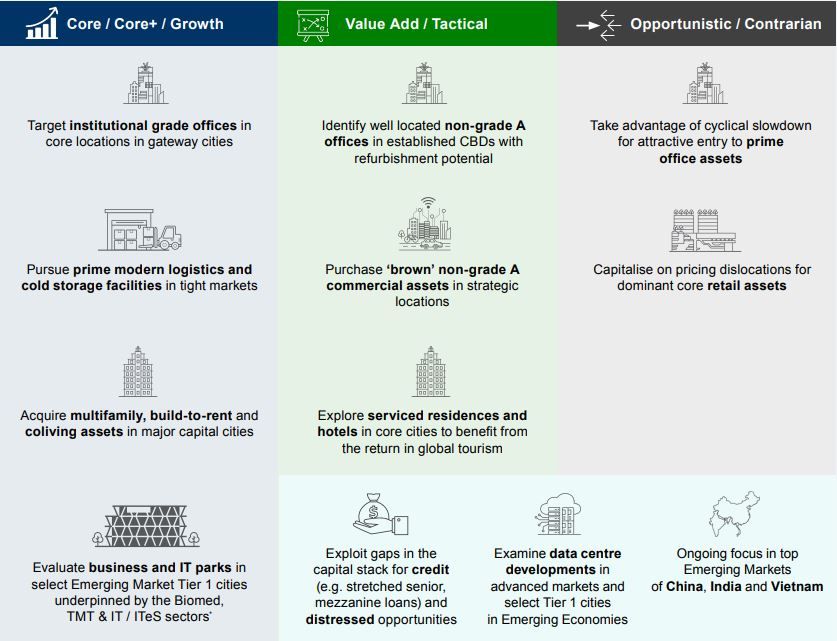

1. Core / Core+: Incremental access to prime-grade commercial assets with solid attributes in strategic locations, and asset classes that will thrive given the current demographic trends and which are well-positioned to deliver stable and risk-adjusted returns

2. Value Add / Tactical: The evolution of workspace strategies has paved the way for potential lower-grade assets that are ripe for repurposing or upgrade as part of a lease-up strategy; incorporating energy efficiency and sustainability practices presents another layer of opportunity within data centre developments and enhancements

3. Opportunistic / Contrarian: Elevated repricing and refinancing risks are creating more viable opportunities for distressed investments, credit strategies, and potentially attractive entry points for core office and retail assets

Figure 1: Summary of Target Investment Strategies in APAC

Source: CLI Group Research, May 2023

*Biomedical, Technology, Media & Telecommunications, Information Technology & Information Technology-enabled Services.

APAC’S APPEAL IN A CROSS-REGIONAL STRATEGY

The market slowdown has spurred investors to explore growth markets in a bid to supplement and diversify their real estate portfolios which typically have a domestic bias, in terms of economic1 and property market2 exposure. APAC is rich with growth markets, with a number of cities well supported by secular tailwinds and robust economic growth potential. We expect the ongoing institutionalisation of APAC markets to deepen the pool of investment products and accelerate their pace of maturity.

Incorporating APAC real estate into a US or European domestic portfolio can meaningfully lower overall volatility and enhance risk-adjusted returns (i.e. gross return per unit of volatility)3. For instance, adding a 30% APAC allocation to a US-only portfolio would improve the gross return per unit of volatility from 0.84 to 1.04 and a Europe-only portfolio would see a similar uptick from 0.59 to 0.85.

In addition, APAC currencies, spurred in part by interest rate differentials, have steadily depreciated against the US dollar since 20214 . This could be an added sweetener for investors looking to increase their exposure to the region.

A MEASURED APPROACH TO FINDING OPPORTUNITY IN VOLATILITY

The real assets investment landscape is riding a wave of unprecedented volatility, which, coupled with heightened interest rates and inflation, has led to a perfect storm of uncertainty. APAC may have many strings to its bow, but it is vital that investors consider the unique risks and challenges of the region, such as political and economic instability, regulatory uncertainty and cultural differences.

Present market dynamics may represent unchartered waters for even the most seasoned of investors, but APAC has proven time and again its flair for reinvention and presenting opportunities in the most challenging of markets.

Download this research paper to explore the richness of APAC and the many opportunities that exist for investors with varied risk and reward appetites and investment horizons.

Download(s)

----------------------------------------

- Economic diversification based on pairwise correlations of GDP growth for the period 1990 to 2022 for US-APAC and EU-APAC which were recorded at 0.45 and 0.58, respectively, while the figure for US-EU was 0.77. Source: Oxford Economics, IMF WEO, CLI Group Research.

- Property market diversification based on pairwise correlations of real estate annual total returns for the period 2007 to 2021 for US NCREIF-MSCI APAC and MSCI Europe-MSCI APAC which were recorded at 0.25 and 0.00, respectively. Source: Bloomberg, MSCI, NCREIF, CLI Group Research.

- CLI Group Research analysis, based on annual data from the US NCREIF Property Index, MSCI Europe Total Returns and MSCI APAC Total Returns for the period 2007 to 2021.

- Between January 2021 and April 2023, the aggregate depreciations of the respective APAC currencies against the US dollar were recorded as follows: Japanese Yen (-29%), Korean Won (-23%), Australian Dollar (-16%), Indian Rupees (-12%), Chinese Yuan (-6%) and Singapore Dollar (-1%).