Ascendas Reit to acquire seven logistics properties in Chicago, United States, for S$133.2 million

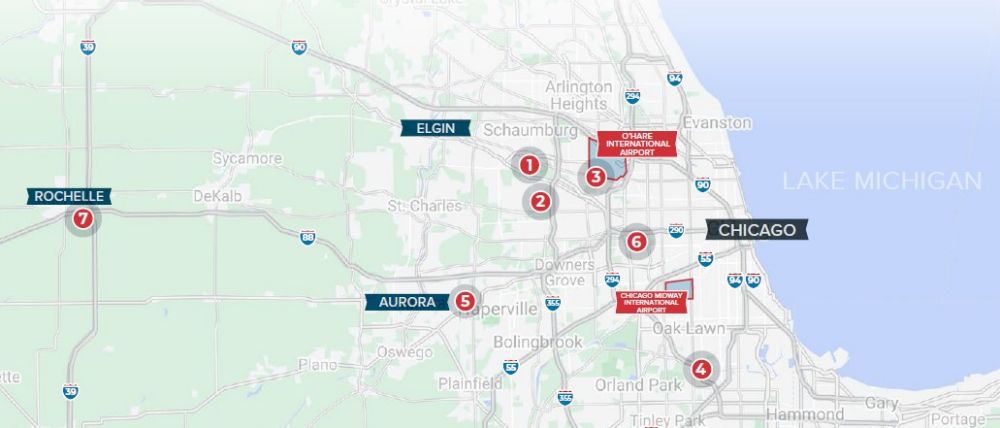

Singapore, 10 May 2022 – Ascendas Funds Management (S) Limited (the Manager), in its capacity as the manager of Ascendas Real Estate Investment Trust (Ascendas Reit), is pleased to announce the proposed acquisition of a portfolio of seven logistics properties located across six infill industrial submarkets across Chicago, Illinois, United States (USA) (the Target Portfolio or Target Properties), for S$133.2 million (US$99.0 million1) (the Total Purchase Consideration) (the Proposed Acquisition) from BREIT Industrial HS Property Owner LLC, BREIT Industrial Canyon IL1M03 LLC, BCORE Jupiter NEMW 1 LLC and Icon Pac Owner Pool 4 Northeast/Midwest, LLC, third-party vendors (collectively, the Vendors).

Mr William Tay, Executive Director and Chief Executive Officer of the Manager said, “Following our successful entry into the USA logistics market in November 2021, we are pleased to acquire another portfolio comprising seven logistics properties in Chicago, the largest industrial market in the country based on existing space. This portfolio comes with a long weighted average lease expiry of 5 years and is 100% occupied by 12 tenants from a diverse range of industries including logistics service providers, engineering companies and a food distributor.”

Key Merits of the Proposed Acquisition

1. Chicago is a major logistics hub in USA supported by a superior combination of transportation modes and infrastructure

Chicago has the largest logistics property market in USA based on existing inventory size (approximately 116.5 million sq m)2. It is also the third largest metropolitan statistical area by population in the USA with over 9.5 million people3 and boasts the country’s third largest economic gross domestic product4.

The strength of the logistics market in Chicago is underpinned by a strong labour force and its unmatched transportation network. According to CBRE Labor Analytics, Chicago has a logistics labour force of 203,000, the third largest in the country.

Chicago also serves as the leading rail hub of USA and a critical interchange point for freight traffic between major railroads and Amtrak’s hub. With its strategic location in Midwestern USA, six out of seven Class 1 railroads operate major terminals out of the region.

The O’Hare International Airport is one of the largest air cargo airports in USA, processing almost 2 million metric tonnes of cargo per annum worth more than US$200 billion5. The airport was also ranked the world’s fourth busiest airport for passenger traffic in 20216.

The two longest interstate routes, I-90 and I-80, run through the region, providing drivers with east coast to west coast access. Together with access to other interstate routes such as I-55, I-65, I-57, I-70 and I-94, a driver can reach almost every population centre in the country by using one interchange in Chicago7.

2. Strong logistics market fundamentals

In 2021, Chicago ranked first in terms of net absorption (4.3 million sq m) in USA surpassing its 2019 and 2020 combined tally8.

Vacancy rate continued to tighten in Chicago. As at 1Q 2022, overall vacancy rate stood at 3.1%, which was 230 basis points lower compared to a year ago. Vacancy rate is expected to fall to the high two percent range in the later part of 20229.

Strong tenant demand and the low availability of space have led to rental growth across the Chicago region. Over the last five years, average asking rent has increased by approximately 3.7% per annum10.

3. Attractive property characteristics and good locations across established infill submarkets

The seven Target Properties are located on freehold land and have highly functional designs. The portfolio has a total net lettable area (NLA) of 132,344 sq m.

The Target Properties are located in infill locations across six growing industrial submarkets, namely, O’Hare, Central DuPage, South Cook County, I-88 Corridor, Southwest Cook County and I-39 Corridor.

On average, the existing customers have occupied their current space for 10.6 years. The long average tenant tenure attests to the attractive infill locations of the Target Portfolio.

4. Resilient income stream

The Target Portfolio is 100% occupied by 12 customers with a weighted average lease to expiry (WALE) of 5.0 years as at 31 March 2022. These customers come from a diverse range of industries such as logistics and supply chain management, distributors, engineering and food & beverage.

No single customer contributes to more than 20% of the total rental income of the Target Portfolio (as at 31 March 2022), thus minimising tenant concentration risk.

The current leases have built-in annual rent escalations ranging between 2.0% and 3.0% per annum.

5. Diversifies Ascendas Reit’s logistics exposure

The Proposed Acquisition is expected to increase and diversify Ascendas Reit’s exposure to logistics properties in USA and across its portfolio.

On a pro forma basis11, the proportion of Ascendas Reit’s logistics properties in USA will increase to 14.6% (S$0.3 billion) from 9.4% (S$0.2 billion) and on a total portfolio basis, the proportion of Ascendas Reit’s logistics properties will rise to 25% (S$4.2 billion) of total investment properties of S$16.5 billion (from S$4.0 billion or 24% of total investment properties of S$16.4 billion).

6. Distribution per Unit (DPU) accretive acquisition

The estimated net property income (NPI) yield12 for the first year post acquisition is approximately 5.3% and 5.1% pre-transaction costs and post-transaction costs respectively.

The Proposed Acquisition will be funded by Ascendas Reit through internal resources and/or existing debt facilities.

The estimated pro forma impact on the DPU for the financial year commencing on 1 January 2021 and ended 31 December 2021 is expected to be an improvement of 0.001 Singapore cents or a DPU accretion of 0.01% assuming the Proposed Acquisition was completed on 1 January 202113.

Valuation of Target Portfolio

In connection with the Proposed Acquisition, an independent valuation on the Target Portfolio was commissioned by HSBC Institutional Trust Services (Singapore) Limited (in its capacity as trustee of Ascendas Reit)14. The independent valuation concluded an aggregate market value of S$140.5 million (US$104.4 million) for the Target Portfolio as of 29 March 202215.

Transaction Costs

Ascendas Reit, through its indirect wholly owned subsidiary, Ascendas REIT Chicago 1 LLC, entered into a purchase and sale agreement with the Vendors to acquire the Target Portfolio.

The Total Purchase Consideration of S$133.2 million (US$99.0 million) was negotiated on a willing-buyer and willing-seller basis.

The completion of the Proposed Acquisition is subject to closing conditions and is expected to take place in 2Q 2022. On completion, the Total Purchase Consideration (less the deposit which has been previously paid to the Vendors) will be payable to the Vendors in cash.

Ascendas Reit is expected to incur an estimated transaction cost of S$3.5 million (US$2.6 million), which includes stamp duty, professional advisory fees, and acquisition fees payable to the Manager in cash (being 1% of the Total Purchase Consideration which amounts to approximately S$1.3 million (US$1.0 million)).

Ascendas Reit will, upon completion of the Proposed Acquisition, own 228 properties. Its total investment properties are expected to be worth approximately S$16.5 billion16 comprising 95 properties (S$10.0 billion[4]) in Singapore, 48 properties in the USA (S$2.4 billion), 36 properties (S$2.3 billion) in Australia and 49 properties (S$1.8 billion) in the United Kingdom/Europe.

Please refer to the Annex for more details.

Notes:

1. An illustrative exchange rate of US$1.000: S$1.3457 is used for all conversions from US Dollar into Singapore Dollar amounts in this press release.

2. Source: JLL Research, 4Q 2021 Industrial Outlook.

3. Source: U.S. Census Bureau, Population Division (Population Estimate (as of July 1, 2021)).

4. Source: U.S. Bureau of Economic Analysis.

5. Source: CBRE, 2022 North America Industrial Big Box.

6. Source: Airports Council International.

7. Source: CBRE, 2022 North America Industrial Big Box.

8. Source: JLL Research, 4Q 2021 Industrial Outlook.

9. Source: JLL Research, 1Q 2022 Industrial Outlook.

10. Source: CBRE, Chicago Industrial MarketView Q4 2021.

11. As at 31 March 2022.

12. The NPI yield is derived using the estimated NPI in the first year after acquisition.

13. The estimated pro forma DPU impact is calculated based on the following assumptions: a) Ascendas Reit had completed the Proposed Acquisition on 1 January 2021, and held and operated the Target Properties through 31 December 2021, b) the Proposed Acquisition was funded based on a funding structure of 40% debt and 60% equity, and c) the Manager elects to receive its base fee 80% in cash and 20% in units.

14. This is in accordance with the requirements of Appendix 6 of the Code on Collective Investment Schemes issued by the Monetary Authority of Singapore.

15. The independent valuer, CBRE Valuation & Advisory Services, has valued the Target Portfolio based on the direct capitalisation and discounted cash flow approaches.

16. Pro forma as at 31 March 2022, excluding one property in Singapore under redevelopment.

17. The asset value excludes one property in Singapore under redevelopment.