Ascendas Reit to acquire a cold storage logistics facility in Singapore for S$191.9 million

14 Sep 2022, Singapore – Ascendas Funds Management (S) Limited, as the manager (the “Manager”) of Ascendas Real Estate Investment Trust (“Ascendas Reit”), is pleased to announce Ascendas Reit’s proposed acquisition of a cold storage logistics facility located at 1 Buroh Lane, Singapore (the “Property”) from A3 Lux Alpha S.a.r.l (the “Vendor”) (the “Proposed Acquisition”). The purchase consideration for the Proposed Acquisition is S$191.9 million (the “Purchase Consideration”).

Mr William Tay, Executive Director and Chief Executive Officer of the Manager said, “This is our first cold storage facility investment in Singapore. This modern Grade-A 5-storey ramp-up logistics facility is one of the best cold storage facilities in Singapore. Featuring a good combination of chiller, freezer and ambient storage spaces, it caters to a diverse food and beverage storage requirements. We are confident to achieve good rental growth due to the limited supply and strong demand for this type of facilities.”

Key Merits of the Proposed Acquisition

1. Aligned with Ascendas Reit’s strategy to expand its logistics portfolio

Demand for warehouse space in Singapore continues to be healthy as companies are expected to increase inventory levels amidst supply chain disruptions, higher freight cost and inflationary pressures. Availability of logistics space remains limited as the upcoming logistics supply has achieved high pre-commitment rates.1

The food sector in Singapore is highly regulated by the authorities and certain food storage and food processing can only be conducted within designated food zones. Limited supply of good quality cold storage facilities is expected to underpin demand and rent growth for this sub-segment.

The Proposed Acquisition is well aligned with Ascendas Reit’s strategic intention to grow its logistics portfolio with quality properties that can meet the demand for warehousing space.

On a pro forma basis2, the proportion of logistics properties will rise to 26%3 (S$4.31 billion) of Ascendas Reit’s total investment properties valued at of S$16.75 billion.

2. Good quality, well-located and modern cold storage facility

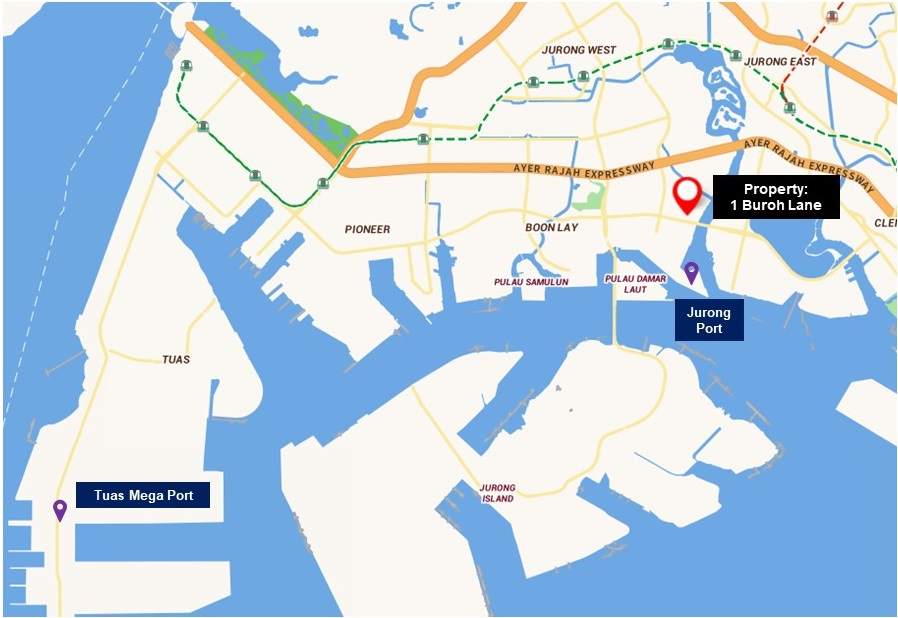

The Property is situated in the western region of Singapore within the Jalan Buroh Food Zone where over 30 licensed food establishments are located. It is located within a 5-minute drive to Ayer Rajah Expressway and is in close proximity to Singapore’s major sea ports e.g. Jurong Port and Tuas Mega Port.

The Property is a five-storey ramp-up logistics distribution centre with chiller, freezer, air-conditioned and ambient storage space as well as ancillary office space. Its specifications cater to the diverse requirements of food producers and distributors, food & beverage retailers and importers etc. who require different types of storage space under one roof.

The modern cold storage facility was newly built about 7 years ago.

3. Fully occupied with long weighted average lease to expiry (“WALE”)

As at 30 June 2022, the Property is fully occupied by five well-established tenants including a supermarket chain and leading distributors of fruits and vegetables. With a long WALE of 7.0 years and built-in rent escalations of 2% to 3% every three years, the Proposed Acquisition is expected to expand Ascendas Reit’s customer base and strengthen its income stability.

4. Distribution per Unit (“DPU”) accretive acquisition

The estimated net property income (“NPI”) yield4 for the first year post acquisition is approximately 7.0% and 6.9% pre-transaction costs and post-transaction costs respectively.

The Proposed Acquisition is expected to be funded by Ascendas Reit through internal resources and/or existing debt facilities. On this basis, the estimated pro forma impact on the DPU for the financial year commencing on 1 January 2021 and ended 31 December 2021 (FY2021) is expected to be an improvement of 0.086 Singapore cents or a DPU accretion of 0.56% assuming the Proposed Acquisition was completed on 1 January 20215.

The Proposed Acquisition is expected to be completed in the fourth quarter of 2022.

Details of the Proposed Acquisition

HSBC Institutional Trust Services (Singapore) Limited, in its capacity as trustee of Ascendas Reit Moonshine Trust (the “Trustee”), entered into a Share Purchase Agreement with the Vendor today, to acquire the total issued share capital of A3 SG ETA PTE. LTD., the holding company of the Property.

The Purchase Consideration of S$191.9 million was negotiated on a willing-buyer and willing-seller basis and is in line with the independent market valuation6 of the Property of S$195 million as of 10 May 2022.

The total cost of the Proposed Acquisition is estimated to be approximately S$196.2 million comprising (i) the Purchase Consideration of S$191.9 million, (ii) the acquisition fee payable to the Manager of approximately S$1.919 million (being 1% of the Purchase Consideration), and (iii) stamp duty, professional and other fees and expenses of S$2.4 million.

Upon completion of the Proposed Acquisition, Ascendas Reit will own 230 properties comprising 97 properties in Singapore, 48 properties in the United States, 36 properties in Australia and 49 properties in the United Kingdom/Europe.

--------------------------------

1. Source: CBRE Research, “A broad-based recovery”, Singapore Q1 2022.

2. As at 30 June 2022.

3. Includes the seven logistics properties in Chicago, United States, that were acquired on 10 June 2022.

4. The NPI yield is derived using the estimated NPI expected in the first year after acquisition.

5. The estimated pro forma DPU impact is calculated based on the following assumptions a) Ascendas Reit had completed the Proposed Acquisition on 1 January 2021, and held and operated the Property through 31 December 2021, b) the Proposed Acquisition was funded 100% by debt, and c) the Manager elects to receive its base fee 80% in cash and 20% in units.

6. This is in accordance with the requirements of Appendix 6 of the Code on Collective Investment Schemes issued by the Monetary Authority of Singapore. The valuation (dated 10 May 2022) was commissioned by the Manager and HSBC Institutional Services (Singapore) Limited (as trustee of Ascendas Reit) and carried out by Savills Valuation And Professional Services (S) Pte Ltd using the discounted cashflow analysis and income capitalisation approaches.