The Benefits of Diversity - APAC’s Role in Investment Portfolio Growth

September 2023

A fast-evolving landscape of geopolitical tension, elevated inflation, rising interest rates, and shifting policy developments presents both challenges and opportunities for investors navigating a wave of transformative change in international asset classes. In particular, as investment funds move to revise their strategies, the dynamic real estate (RE) markets of the Asia Pacific (APAC) are now drawing increasing attention, as managers seek to tap their historically strong track record for growth as well as their potential for portfolio diversification at a time of rising levels of market risk.

Recent market developments have increased pressure on global investors to explore growth markets, which offer a combination of benefits including robust secular tailwinds, strong demand fundamentals, rapid urbanisation, and the growing influence of an emerging middle-class. In this context, APAC has consistently held a leading position as a result of its long-term prospects for solid growth. Beyond that, the ongoing institutionalisation of APAC markets should also serve to enhance the investment pool as they attract more inward foreign direct investment and increase the number of product offerings.

A strategic focus on growth markets (and in particular on APAC) not only helps generate alpha but also offers a way to diversify investment portfolios1 by mitigating risks associated with traditional markets and products — an increasingly crucial feature given the limited options for enhancing returns in the current environment.

Global investors should consider exploring APAC RE markets to diversify their portfolios and potentially improve risk-adjusted returns2.

Based on our analysis, incorporating APAC RE into a global portfolio has significant potential to augment portfolio values. Key benefits include:

1. APAC: A CATALYST FOR ECONOMIC DIVERSIFICATION ACROSS MARKETS

Capitalising on Economic Correlations

The first factor that makes APAC a compelling choice is the potential for economic diversification. This is apparent from the pairwise correlations of annual GDP growth between APAC, US and EUR markets during the period 1990 to 2022 (Figure 1). The pairwise correlation for APAC-US is lowest, with APAC-EUR correlation marginally higher. Notably, US-EUR correlation for the same period was significantly higher, reflecting the stronger positive relationship between the two economies.

Figure 1: Pairwise Correlation of Annual Real GDP Growth (1990 to 2022) by Region

2. APAC RE: OPPORTUNITIES FOR ASSET CLASS DIVERSIFICATION

Asset Symphony: Seeking Harmony in Low Regional Correlation

With APAC RE already providing significant total returns on a stand-alone basis, we then analysed the value-add of potential diversification by including RE as part of a global investment portfolio alongside other asset classes, including equities, bonds, and REITs.

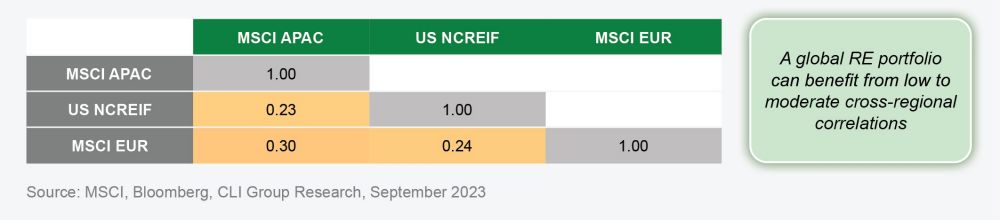

Using a global RE portfolio as a baseline, we see obvious diversification benefits reflected in the low-to-moderate pairwise correlation range of 0.23 to 0.30 between three regional indices (Figure 2). Correlation variations between US, APAC and EUR regions are mostly attributed to differences in occupier profiles, lease structures, and land use policies, amongst others.

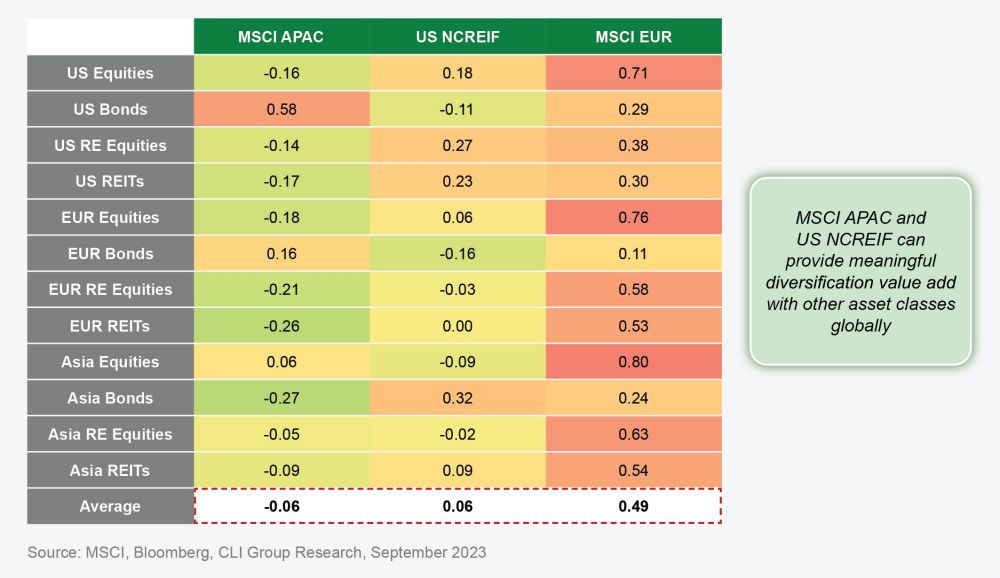

When other regional asset classes were included in the analysis, returns from APAC and US RE consistently displayed low-to-negative correlations. On the flipside, EUR displayed considerably stronger correlation across regions and asset classes, indicating fewer diversification benefits (Figure 3).

Figure 2: Pairwise Correlation of USD RE Total Returns (2007 to 2022) by Region

Figure 3: Pairwise Correlation of USD RE Total Returns (2007 to 2022) by Asset Class

3. ENHANCED RISK-ADJUSTED RETURNS VIA ALLOCATION TO APAC RE

Approach to Optimising RE Portfolio Strategy

A final benefit offered by APAC RE is that investors can meaningfully improve risk-adjusted returns while simultaneously reducing overall risk through a sound system of portfolio construction and rebalancing.

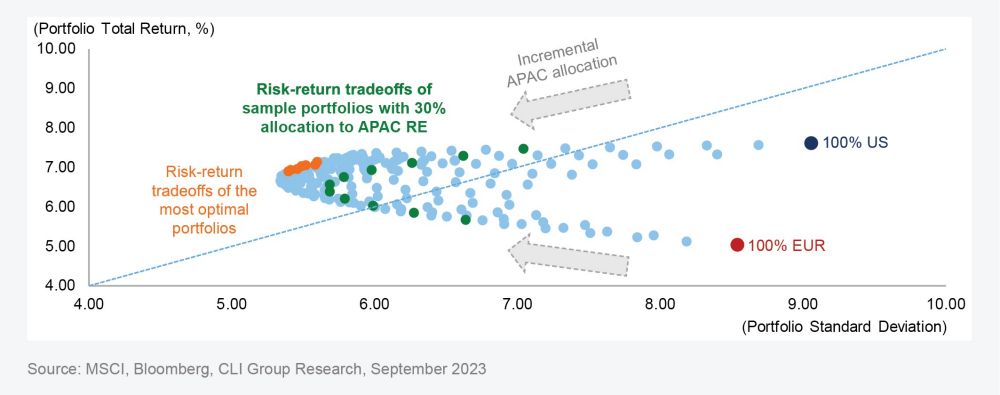

An assessment was undertaken to analyse portfolio allocation scenarios that offer maximum expected total returns for a given level of risk. This involved plotting an efficient frontier representing a range of hypothetical portfolios. This could then be used by investors to evaluate potential risk/return tradeoffs compared to their own portfolios.

Although portfolio compositions indicating 55% to 65% APAC, 21% to 32% US, and 8% to 18% EUR achieved the highest level of risk-return tradeoffs (Figure 4), we recognise these allocations may not be feasible for investors whose primary focus lies outside the APAC region.

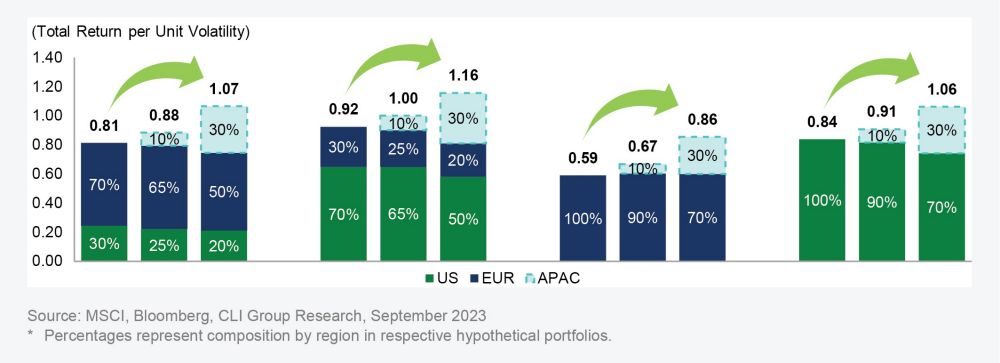

To address this, we framed the analysis with lower and upper allocation limits to ensure portfolio compositions remained reasonable and were aligned with US and/or EUR-centric investors. After applying a hypothetical 10% and 30% allocation to APAC RE (Figure 5), the results suggest that additions are accretive to risk-adjusted returns, with the constrained maximum level of 30% providing the highest value add.

Figure 4: RE Portfolio Total Return vs. Standard Deviation – Efficient Frontier

Figure 5: Total Returns per Unity Volatility – Select RE Portfolio Mix with 10% and 30% Allocations to APAC*

REBALANCING AND FUTURE-PROOFING RE PORTFOLIOS IS KEY

The conclusion from this analysis is that inclusion of APAC RE into global investment portfolios offers investors dual benefits: an opportunity to tap the region’s robust economic growth and attractive RE market total returns, while at the same time achieving a high level of portfolio diversification by adding real assets that demonstrate low correlation with other global asset classes.

To optimise performance, maintaining a well-balanced RE portfolio is essential. This requires regular strategic reviews and adjustments to portfolio allocations, with a specific focus on APAC RE. The objective is to minimise volatility and achieve favourable risk-adjusted returns over the long term. Collaborating with established regional investment managers who possess extensive local presence and operational proficiency can provide valuable insights for navigating a multitude of diverse APAC RE markets.

By adopting these strategies, investors can effectively respond to market dynamics, optimise risk-adjusted returns, and position themselves for sustained success in a fast-changing RE investment landscape.

Download(s)

----------------------------------------

- Refer to CLI Group Research Topical Paper – Finding Opportunity in Volatility within Asia Pacific: Reprioritising Fundamentals in Challenging Times, June 2023.

- Measured by the total return per unit of volatility, based on the ratio of the average gross total returns to standard deviation for each hypothetical investment portfolio.