Our Sustainability Approach

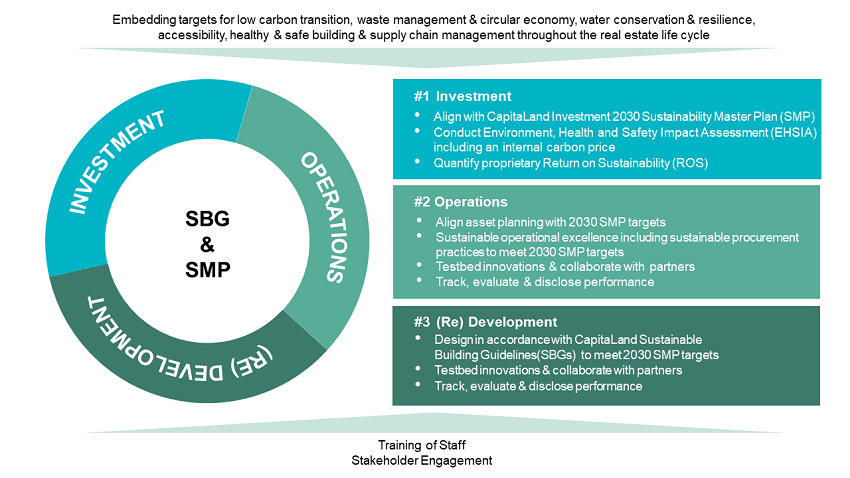

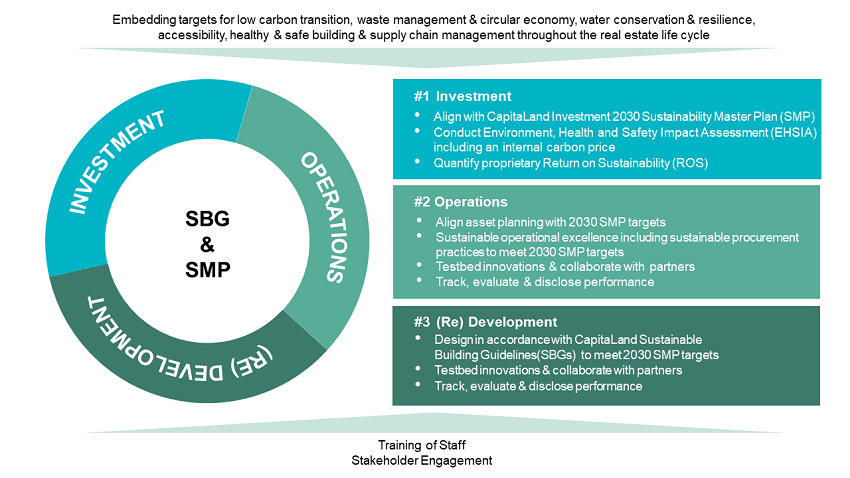

We integrate sustainability into the real estate life cycle. We are committed to grow in a responsible manner, deliver long-term economic value and contribute to the environmental and social well-being of our communities.

We will integrate a low-carbon strategy into our real estate life cycle from investment, design and construction, and procurement to operations. It includes reducing the carbon footprint throughout the life cycle of our buildings through procuring building materials with lower embodied carbon and more efficient building design and construction.

For more information on the CapitaLand Investment 2030 Sustainability Master Plan, our framework and our targets, please visit here.

Sustainability integration in the real estate life cycle

CapitaLand Investment (CLI) incorporates environmental sustainability throughout the life cycle of its real estate projects including acquisition, design, procurement, construction, operations and redevelopment.

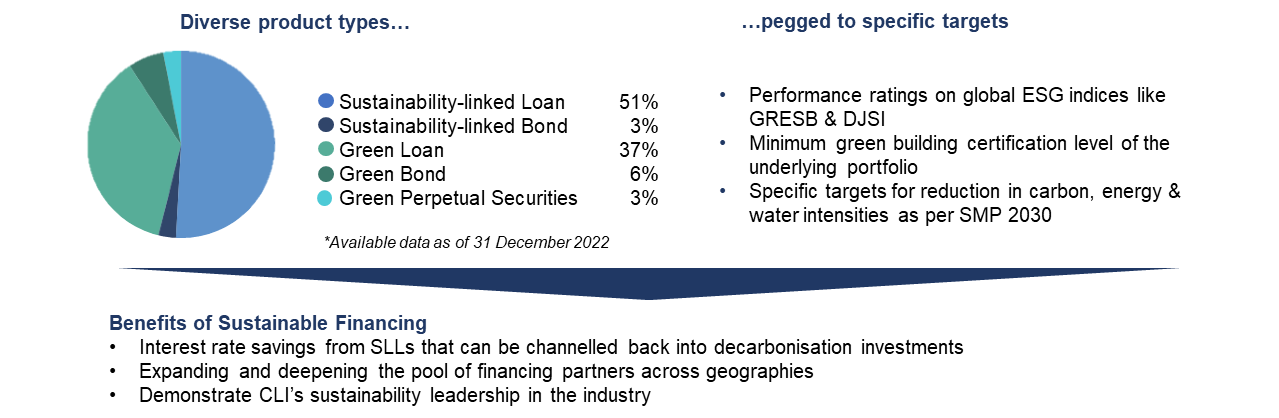

Sustainable finance

We leverage sustainable finance for decarbonisation. Over S$11.6 billion was raised in sustainable finance since 2018 by CapitaLand Investment (CLI) Group including its listed REITs and business trusts. Capitaland Investment obtained the first and largest sustainability linked loan in Asia's real estate sector in 2018. We also obtained the first loan facility agreement referencing Singapore Overnight Rate Average (SORA) in Singapore back in 2020.

Our carbon mitigation strategy

CapitaLand Investment's carbon mitigation strategy towards Net Zero by 2050 is prioritised in the following order:

You may also be interested in

-

-

CapitaLand Investment Global Sustainability Report 2023

-

-

CapitaLand Investment Climate Resilience Report 2023