About CapitaLand Group

CapitaLand Group (CapitaLand) is one of Asia’s largest diversified real estate groups. Headquartered in Singapore, CapitaLand’s portfolio focuses on real estate investment management and real estate development, and spans across more than 260 cities in over 40 countries.

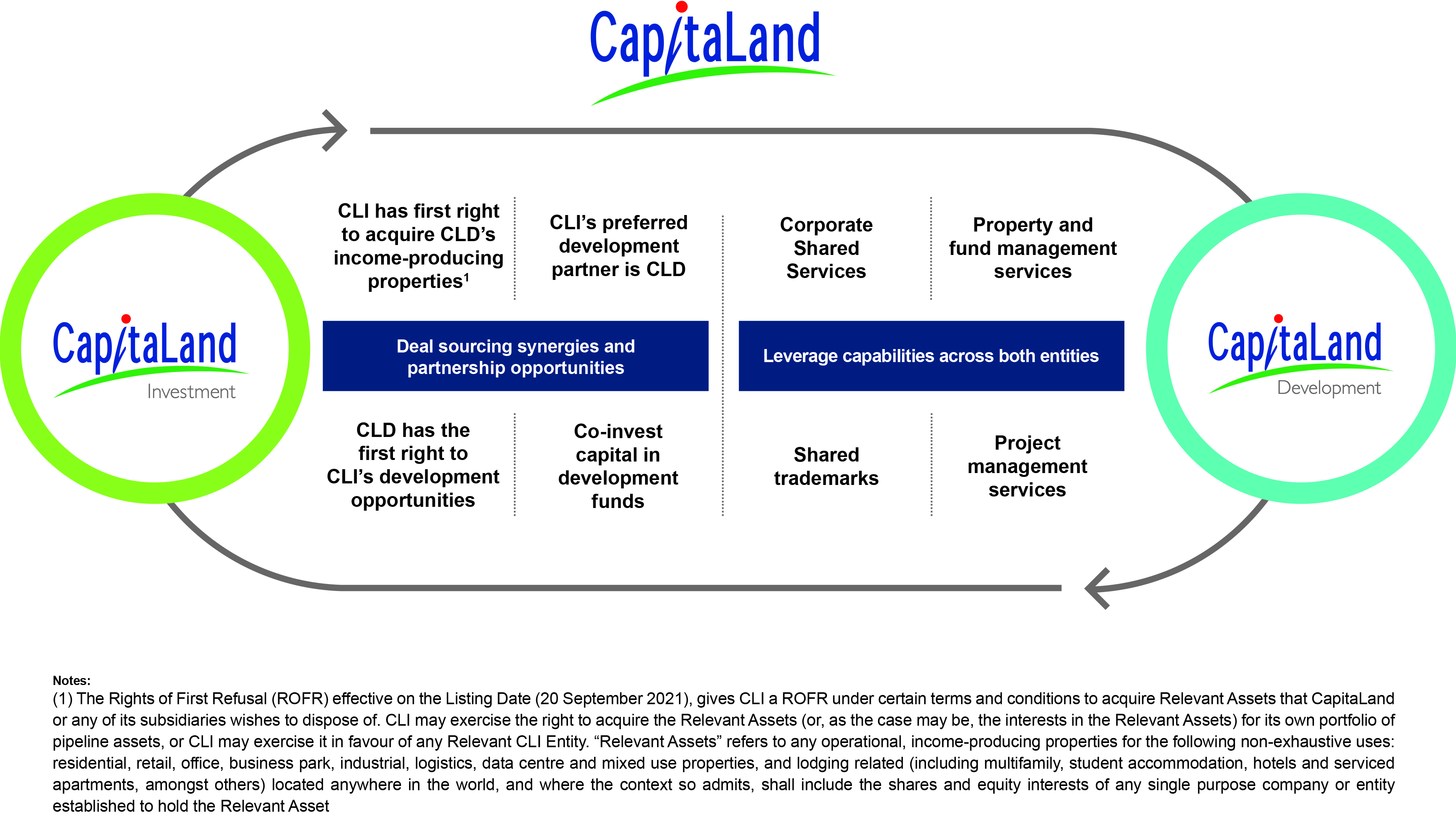

Within its ecosystem, CapitaLand has developed an integrated suite of investment management and operating capabilities that supports its real estate businesses and platforms in building core competencies across the real estate value chain. With this full stack of capabilities, CapitaLand can optimise the strategies of its listed real estate investment management business CapitaLand Investment (CLI), and its privately held property development arm CapitaLand Development (CLD), to drive competitive advantage for its businesses.

CapitaLand places sustainability at the core of what it does. As a responsible real estate company, CapitaLand contributes to the environmental and social well-being of the communities where it operates, as it delivers long-term economic value to its stakeholders.

CapitaLand Investment

Headquartered and listed in Singapore, CapitaLand Investment is a leading global real asset manager with a strong Asia foothold.

CapitaLand Development

The development arm of the CapitaLand Group, CapitaLand Development is committed to continue creating quality spaces for work, live and play in the communities in which it operates, through sustainable and innovative solutions.

Our Ecosystem