Financial and Technological Innovation for Sustainability : Environmental, Social and Governance Performance, Chapter 6, pages 134-142, Edn. 1, by Routledge. © 2024 selection and editorial matter, Artie Ng and Jatin Nathwani; individual chapters, the contributors. Reproduced by permission of Taylor & Francis Group.

Case Study

With the rapid growth of SLLs in the region and Singapore leading the way as a sustainable finance hub in ASEAN, the following case study explores how Singaporean global real estate investment manager, CapitaLand Investment Limited (CLI), has been leveraging the opportunities brought by sustainable finance in recent years. The case study is based on desktop research and interviews with CLI.

Company Background

Headquartered and listed in Singapore, CLI is a leading global real estate investment manager with a strong foothold in APAC. CLI was listed on the Singapore Exchange in September 2021 following the restructuring of CapitaLand Limited into two distinct business entities – CLI, the listed real estate investment management business, and CapitaLand Development, the privatised property development arm.

As of September 2022, CLI had approximately S$130 billion (US$97.1 billion1) of real estate assets under management, approximately S$86 billion (US$64.2 billion) of real estate funds under management held via six listed Real Estate Investment Trusts (REITs) and business trusts, and approximately 30 private vehicles across APAC, Europe, and the United States. Its diversified real estate asset classes cover retail, office, lodging, business parks, industrial, logistics, and data centres.

Environmental, Social, and Governance (ESG) Track Record

Over the years, CLI has placed a strong emphasis on sustainability and has committed to achieving net-zero for their scope 1 and 2 emissions by 2050. To support this long-term target, the company has also set an ambitious short-term target to reduce its absolute scope 1 and 2 emissions 46% by 2030 from a 2019 base year. In accordance with best practices, CLI had the target reviewed by the Science-Based Targets initiative, who validated it as being aligned to the 1.5 °C pathway outlined in the goals of the Paris Agreement. As a multinational corporation with a presence in more than 30 countries, CLI has also aligned its efforts and objectives with national-level goals in the markets in which it operates.

To achieve these targets, CLI is investing in research and development to foster innovation and partnerships, as well as exploring emerging technologies to raise the bar on environmental stewardship and accelerate its transition to net-zero emissions. For example, the company is exploring ways to improve energy efficiency at its properties while increasing the proportion of renewable energy usage at the same time. In 2021, CLI expanded its use of renewable energy at 21 properties across Singapore, China, India, Australia, Belgium, and the United Kingdom, mitigating approximately 28,960 tonnes of carbon emissions.

CapitaLand Investment's International Tech Park Chennai - Radial Road, the first Indian Green Building Council Net Zero business park in India.

CapitaLand Investment elevated its ESG efforts with the refreshed 2030 Sustainability Master Plan in 2023.

In 2020, CapitaLand launched its 2030 Sustainability Master Plan, a strategic blueprint outlining the company’s ESG goals and how to achieve them (CapitaLand, 2020b). For example, under the pillar of ‘Accelerate Sustainability Innovation and Collaboration’ in the 2030 Sustainability Master Plan, CapitaLand initiated the ‘CapitaLand Sustainability X Challenge’ (CSXC), inviting ideas for innovations to make buildings more climate-resilient and resource-efficient. Following its inaugural challenge in 2021, the company is now piloting six innovations in Singapore and the United States with the aim of scaling successful pilots across its portfolio. The second CSXC in 2022 attracted more than 340 entries across 50 countries (CapitaLand, 2022). Through the challenge, CLI aims to accelerate its progress to meet the 2030 Sustainability Master Plan targets, with decarbonisation being a key pillar. To support and complement the CSXC, CapitaLand also launched the S$50 million (US$37.3 million) CapitaLand Innovation Fund with a strong focus on identifying and test-bedding new and innovative sustainability solutions. At least half of the fund is set aside for sustainability innovations. Furthermore, to support its decarbonisation targets, CLI set a target to raise S$6 billion (US$4.5 billion) through sustainable finance by 2030. As of 31 December 2022, CLI and its listed REITs and business trusts successfully raised S$11.6 billion (US$8.66 billion) through such instruments.

CLI and Sustainable Finance

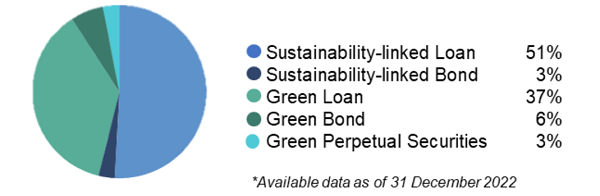

Sustainable finance is part of CLI’s overall ESG efforts and has several benefits in addition to generating financial returns. As of 31 December 2022, CLI and its listed REITs and business trusts had partnered with 17 financial institutions to secure a total of S$11.6 billion (US$8.66 billion) in sustainable finance comprising SLLs, SLBs, green loans, green bonds and green perpetual securities.

Figure 6.6 Breakdown of sustainable finance raised by CLI and its listed REITS and business trusts by instrument type as of 31 December 2022.

In 2018, CapitaLand secured its first SLL from DBS Bank Ltd. (DBS), raising S$300 million (US$224 million) and making it the largest SLL in Asia’s real estate sector at the time (CapitaLand, 2018). The following year, CapitaLand became the first company in Asia to partner with Société Générale for an SLL and became the first real estate partner in the region for Crédit Agricole Corporate and Investment Bank (CACIB) and Natixis for SLLs

By May 2020, CapitaLand and its REITs had raised over S$2.42 billion (US$1.81 billion), and CapitaLand had achieved interest savings on its existing SLLs (CapitaLand, 2020a).

As of 31 December 2022, the list of banks that CLI and its listed REITs and business trusts have partnered with for sustainable financing include Australia and New Zealand Banking Group Limited, Bank of China Limited, CIMB Bank Berhad, CACIB, DBS, JPMorgan Chase Bank, Malayan Banking Berhad, Mizuho Bank, Ltd., MUFG Bank, Ltd. (MUFG), Natixis, Oversea-Chinese Banking Corporation Limited (OCBC), Shanghai Pudong Development Bank, Société Générale, The Bank of East Asia (BEA), The Bank of Nova Scotia, The Hongkong and Shanghai Banking Corporation Limited, and United Overseas Bank Limited (UOB).

In alignment with the emerging global trend, CLI’s sustainable finance instrument of choice has been SLLs. Of the S$11.6 billion (US$8.66 billion) raised by CLI and its listed REITs and business trusts through various sustainable finance instruments by the end of 2022, 51% were attributable to SLLs (see Figure 6.6).

As discussed previously, SLLs are loans that are tied to the borrower’s achievement of predetermined sustainability performance objectives. The borrower’s sustainability performance is assessed and measured using KPIs and often by external rating organisations, such as the DJSI or GRESB). Unlike green loans, the use of proceeds from SLLs is not required to be allocated to specific ESG activities and can be used for general corporate purposes.

GRESB assesses and benchmarks the ESG performance of real estate companies and funds, providing standardised and validated data to capital providers in the property sector. CapitaLand has been a long-time participant in the annual GRESB assessment and achieving a high rating. In 2022, CLI maintained the highest 5-star rating, placing it in the top 20% of the benchmark globally.

DJSI tracks the performance of the world’s leading companies on their ESG efforts. CapitaLand has maintained its listing on both the Dow Jones Sustainability World Index and the Dow Jones Sustainability Asia-Pacific Index for several consecutive years, reinforcing its reputation and creating more favourable terms for sustainable financing.

Benefits

For SLLs that are pegged to CLI’s performances on such indices, CLI noted several key benefits, including flexibility, efficiency, and financial benefits.

- Flexibility: SLLs allow CLI to use the funds raised for general corporate purposes, whereas proceeds from green loans must be used to fund eligible green projects. This allows for greater flexibility and for CLI to prioritise its sustainability efforts in a dynamic manner.

- Efficiency: Most of CLI’s SLLs are pegged to annual sustainability assessments such as the DJSI and GRESB. Since these are accepted by the relevant financial institutions that CLI partners with within the sustainable finance landscape, CLI was not required to hire additional assessors to review its performance.

- Financial benefits: CLI can leverage emerging opportunities in the sustainable finance landscape to reap additional financial outcomes from the successful and early integration of sustainability initiatives into its business. By maintaining or improving its rating/scoring on the relevant ESG benchmarks, CLI will typically obtain interest savings on the SLLs.

In addition to the abovementioned benefits, CLI also noted several other benefits from its broader experience with sustainable finance. First, CLI’s involvement in the sustainable finance marketplace has increased its diversity and options in financing partners and opportunities across geographies. Sustainable finance also allows for nonfinancial value creation, such as increased awareness of the company’s sustainability efforts. For example, depending on the type of sustainable finance instruments, such initiatives often require an undertaking by the borrower to maintain or improve its ESG performance or use the proceeds for ESG activities, which demonstrates the company’s sustainability commitments and maturity, not only to its shareholders but also to wider stakeholder groups.

With growing public expectations and a greater focus on sustainability, embracing sustainable finance initiatives enables CLI to communicate its efforts while also having direct benefits on their bottom line. For some of the initiatives, interest rate savings are channelled back into CLI decarbonisation efforts.

Finally, integrating CLI ESG performance with financial metrics ensures alignment with their long-term focus on sustainability and responsible growth across business units and geographies.

CLI and SLLs

Throughout 2022, CLI and its listed REITs and business trusts secured S$4.7 billion (US$3.51 billion) in sustainable financing through 22 sustainable financing instruments. Of this, S$1.25 billion (US$0.93 billion) came from seven SLLs pegged to GRESB. CLI’s inclusion in the DJSI is also tied to the interest rates across four of CLI’s existing SLLs totalling S$600 million (US$448 million). By maintaining its listing on the DJSI, along with the achievement of other ESG indicators, CLI will enjoy savings from reduced interest rates on these SLLs (see Table 6.1 below).

Ruben Langbroek, GRESB’s Head of APAC, said,

We would like to commend CLI and its listed trusts for consistently achieving top ratings in the GRESB assessments. CapitaLand has been an early participant in the GRESB assessments since 2011, and it has continued to demonstrate leadership in sustainability in the real estate sector. By pegging their SLLs to their GRESB rankings, CLI and its listed trusts have shown their commitment to delivering tangible results to investors. We encourage more organisations to adopt GRESB for their sustainable financing as we progress towards a climate-resilient future.

Table 6.1: Examples of SLLs secured by CLI and its listed REITs and business trusts

Examples of SLLs secured by CLI & its listed REITs and business trusts |

||

Year |

Details |

Assessment Method |

2018 |

DBS issued a S$300 million (US$224 million) multi-currency SLL to CapitaLand where the five-year term loan and revolving credit facility was the first and largest SLL in Asia’s real estate sector, as well as Singapore’s largest sustainability-linked financing provided by a sole lender at that time.

|

CLI’s listing on the DJSI and performance measured against the ESG indicators of the S&P Global Corporate Sustainability Assessment. |

2020 |

UOB issued a four-year S$500 million (US$373 million) SLL to CapitaLand, which is the largest sustainability-linked bilateral loan in Singapore’s real estate sector. |

CLI’s performance on GRESB.

|

2020 |

OCBC and CapitaLand signed Singapore’s first loan facility agreement referencing Singapore Overnight Rate Average (SORA). The S$150 million (US$112 million) SORA-based loan is part of a S$300 million (US$224 million) SLL extended by OCBC to CapitaLand. |

CLI’s performance on GRESB.

|

2021 |

MUFG issued a S$400 million (US$299 million) SLL to CLI, making it CLI’s first SLL issued by MUFG’s Singapore branch. |

CLI’s performance on GRESB.

|

2022 |

BEA issued a US$36 million SLL to CapitaLand Ascott Trust (CLAS). |

CLAS’ performance on GRESB.

|

Managing Sustainable Finance Within CLI

Internally, the key stakeholders overseeing CLI’s sustainable finance initiatives include Group Sustainability and Group Treasury. They report to the Group Chief Operating Officer and the Group Chief Financial Officer (CapitaLand Investment, 2022) and are responsible for meeting CLI’s objective to raise S$6 billion (US$4.5 billion) through sustainable financing by 2030 in alignment with CapitaLand’s 2030 Sustainability Master Plan (CapitaLand, 2020b).

To identify and pursue new sustainable finance opportunities for CLI, Group Treasury is tasked with identifying relevant financial institutions and negotiating financing arrangements. Cross-team coordination between Group Treasury and Group Sustainability is also important to ensure that the sustainability indicators identified for CLI’s sustainable finance instruments are appropriate and aligned to the 2030 Sustainability Master Plan.

When a sustainable finance instrument is secured, CLI will ensure its effective operation by working closely with its external partners from financial institutions to ensure ongoing alignment. As mentioned, with SLLs, communication and coordination is usually made easier for all involved stakeholders due to the inclusion of credible and impartial third-party indices such as DJSI and GRESB, on which CLI performance objectives can be clearly agreed upon and assessed.

Ruben Langbroek, Head of APAC at GRESB, said,

GRESB assesses and benchmarks the ESG performance of real estate companies and funds, providing standardised and validated data to the most sophisticated capital providers in the property sector. CapitaLand has been a long-time participant in the annual GRESB assessment and has shown a strong track record of adhering to best practices on material ESG issues. It is great to see their ongoing commitment to further enhance their ESG performance demonstrated by this latest SLL secured based on their GRESB performance. As the number of green financing instruments grows around the world, this is benefitting real estate companies and funds with a strong ESG performance and provides important incentives for the industry to transition to a low-carbon, safe and resilient future.

To ensure that CLI performs against its overall ESG targets and objectives, the company has been leveraging technology to track key metrics such as energy and water usage, waste generation, and carbon emissions of its properties via the online CapitaLand Environmental Tracking System (CL ETS) since 2008. The CL ETS includes CLI’s global portfolio of integrated developments, retail, office, lodging, business parks, industrial, logistics, and data centres. The CL ETS also tracks the energy and paper consumption of CLI corporate offices in Singapore and overseas. CLI can use the platform to survey various initiatives implemented at its properties globally, allowing monitoring of ESG performance across businesses and geographies in a timely manner, as well as ensuring alignment and progress towards its overarching goals and objectives.

As the demand for high-quality ESG data has spiked in recent years, digital data solutions are rapidly evolving and improving. CLI is also taking advantage of this and migrated its CL ETS to a new cloud-based platform in 2019. This further improved the ETS by enhancing data tracking and accuracies. The software allows each property to conduct analysis against set targets and past trends to understand consumption patterns and identify areas for improvement. The consolidated data are also analysed at the business unit and CLI levels against its overarching ESG targets. This allows for a better understanding of consumption patterns and identification of areas for eco-efficiency improvements across its global portfolio. In 2021, the ETS was further improved to enable assessments of its properties’ performance against their 2030 Sustainability Master Plan targets. To ensure data completeness and accuracy, CLI also conducts regular manual desktop audits. All performances are publicly disclosed in CLI Group’s Global Sustainability Report, which is externally assured to the AA1000 Assurance Standard.

By utilising a comprehensive and digitalised ESG monitoring system, CLI ensures progress against its KPIs and alignment with its commitments to SLLs and other sustainable finance initiatives.

Insights

When CLI first started pursuing sustainable finance initiatives, it faced the challenge of being an early mover in a region that was relatively new to sustainable debt. There were few peers in the region to learn from, and there were even fewer financial institutions with active sustainable finance opportunities to pursue. However, CLI was learning by doing. They found that securing an SLL requires a strong track record on ESG, as well as a clear roadmap that outlines the company’s future commitments to enhanced sustainability performance. Companies that are interested in raising capital through sustainable finance instruments also need to be transparent in their ESG performance in a credible manner, such as allowing for the assessment of their ESG efforts by reliable and trustworthy third-party organisations.

A proven track record of ESG performance, credible and ambitious commitments that align with best practice (e.g. setting science-based emissions reduction targets that are aligned with the goals of the Paris Agreement), and transparency can position a company to be able to attract and raise capital through sustainable finance instruments. For certain types of sustainable finance instruments, such as SLLs, it is also crucial to demonstrate progress against ESG commitments to maintain the loan throughout its tenor. For this type of loan, a continued emphasis on maintaining and improving the organisation’s overall sustainability performance will often allow the borrower to gain financial benefits through more favourable interest rates on a tiered basis.

CapitaLand started its sustainability journey a decade ago and has consistently performed well in its ESG initiatives. For dedicated companies such as CLI, their sustainability commitments have created new opportunities with a range of benefits. The ESG landscape is constantly evolving, and by maintaining an ongoing commitment to its sustainability, CLI is better positioned to reap the benefits of new and emerging opportunities in the sustainable finance marketplace.

1 The conversion from SGD to USD equivalent amounts are based on Bloomberg’s exchange rate (USD/SGD: 1.3395) as of 30 December 2022.

Get the full copy of the book here.

You may also be interested in

-

-

Case Study: Green Opportunities from Retrofitting Heritage Buildings - Singapore

-

-

Case Study: Collaboration to Advance Net Zero Movement in India through First Net Zero Business Park in India

HIII